TechRadar Verdict

CreditKarma makes a lot of sense for anyone who wants to better manage their personal finances, without committing too much time in order to do it. Just look out for the hard sell once inside.

Pros

- +

Comprehensive site and app

- +

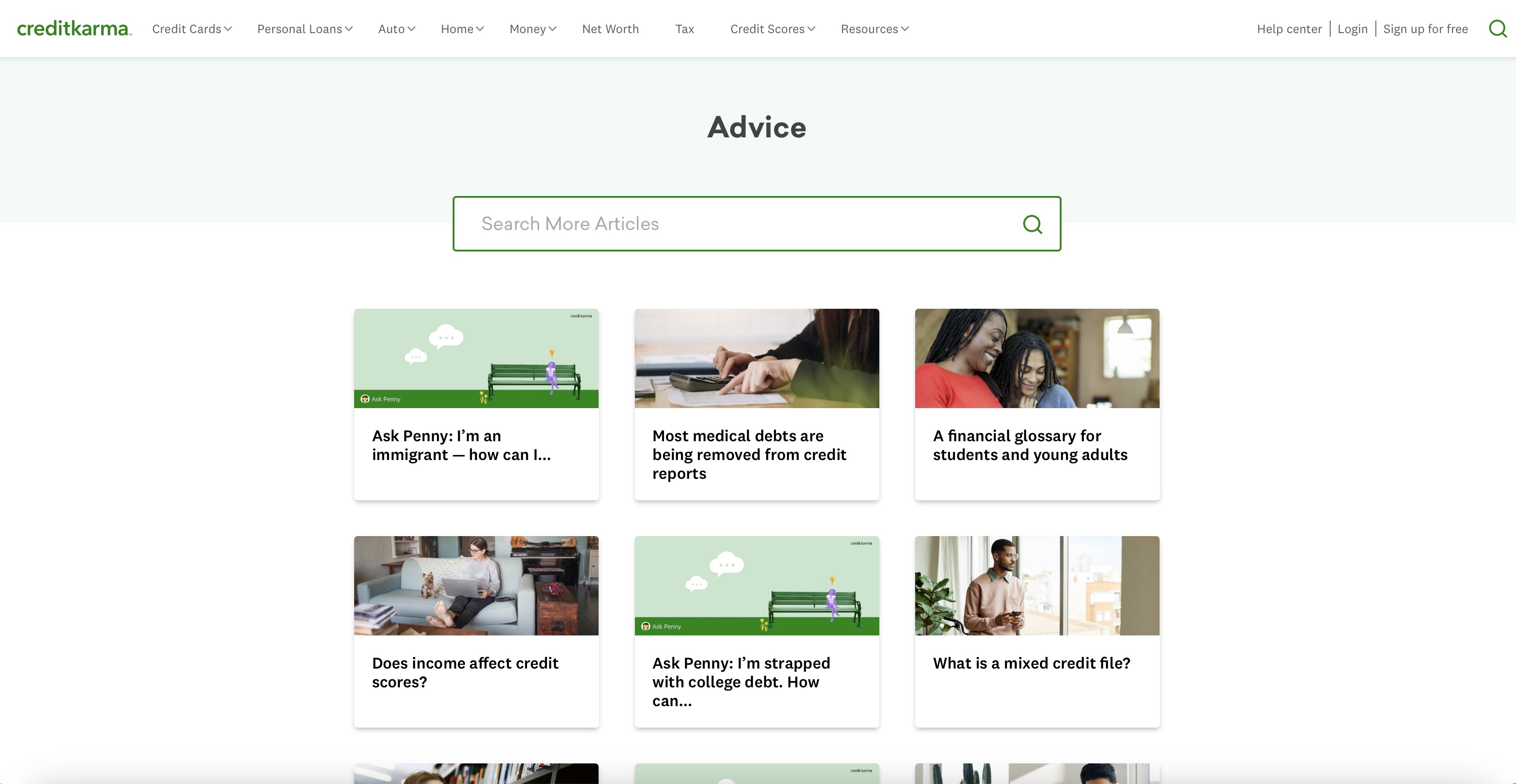

Advice sections can prove useful

- +

A handy one-stop overview for products

Cons

- -

Almost too many deals and offers

- -

Not as good as Intuit’s old Mint app

- -

Could do with more practical tools

Why you can trust TechRadar

CreditKarma is part of the Intuit company, which also owns the likes of TurboTax, Quickbooks and Mailchimp. It’s been designed to make life easier when it comes to monitoring personal finances, with tools that cover everything from credit ratings and card ownership through to offering help with tax and accounts.

Adding to the appeal are options for handling everyday essentials on the money front as well as guidance on loans plus home and auto matters. CreditKarma comes with a sign up for free option for anyone just curious as to how useful if can be to them. Intuit reckons over 130 million members are already part of the CreditKarma club, which suggests it must be doing something right although it's not as appealing as the now defunct Mint app, also owned by Intuit.

- Want to try CreditKarma? Check out the website here

One of the most important issues relating to the best personal finance software packages is ease of use. Convenience and time-saving features are vital, which is some that Credit Karma aims to offer. So, if you find staying on top of monetary matters a chore and welcome help when it comes to filing tax returns or optimising how you spend and save, CreditKarma could be worth exploring.

CreditKarma: Pricing

The best personal finance software market is a competitive one, which means that Intuit has to provide value for money when it comes to CreditKarma services. The initial sign-up process can be done for free, which is obviously appealing.

Naturally, with something that comes as free initially, CreditKarma can also tend to provide the user with a bewildering blizzard of financial products. The deeper you get into its offerings, the more this seems to intensify. It’s fine for anyone looking for such things, but this can also detract from the initially appealing free stance.

CreditKarma: Features

CreditKarma works by offering free access to your credit score and, from there, allows much more effective management of personal finances. It’s a sort of helping hand, offering guidance as to the best way to move forwards, which could be a real boon for anyone who struggles with managing personal money matters.

Once you’ve signed up for an account, you’ll have your own log-in details, which will enable you to peruse personal credit scores from the leading names including TransUnion and Equifax. Being able to do this at your leisure and whenever it suits can be very handy as is the suggestions CreditKarma makes to help you navigate your money management chores.

CreditKarma: Performance

Many of use lead such busy lives that staying on top of personal finances can be tricky. So aside from the desktop website, CreditKarma works best when it’s used via the app. This means it’s quick and easy to tap into the incredible array of help and guidance using Intuit’s large-scale volumes of data. It also means that checking the latest deals of loans, credit cards and mortgages can be done on-the-go too.

Such is the level of information offered, both via the desktop website and through the app, Intuit has done a great job and users of CreditKarma might end up finding it their won one-stop shop when it comes to managing personal finances. It’s all here, and everything seems to flow very nicely indeed too. So, it’s a thumbs-up to CreditKarma on the operational front.

CreditKarma: Ease of use

As expected, the slick CreditKarma website and app combination works every bit as easily as other products in the Intuit portfolio. This is a big company, with seemingly endless resources so it’s little wonder that using the CreditKarma features and functions is a breeze. However, it’s interesting that Intuit also owns budgeting app Mint, which was very popular with lots of people.

Since the acquisition though, Intuit has closed down the apparently loss-making Mint and now points customers in the direction of CreditKarma. Some users who have done this report that it’s not such plain sailing and another complaint is that there are less budgeting features and functions on offer compared to Mint. However, CreditKarma does make it immediately obvious that it is more concerned with offering advice on credit scores. And for that purpose, it seems to work well enough.

CreditKarma: Support

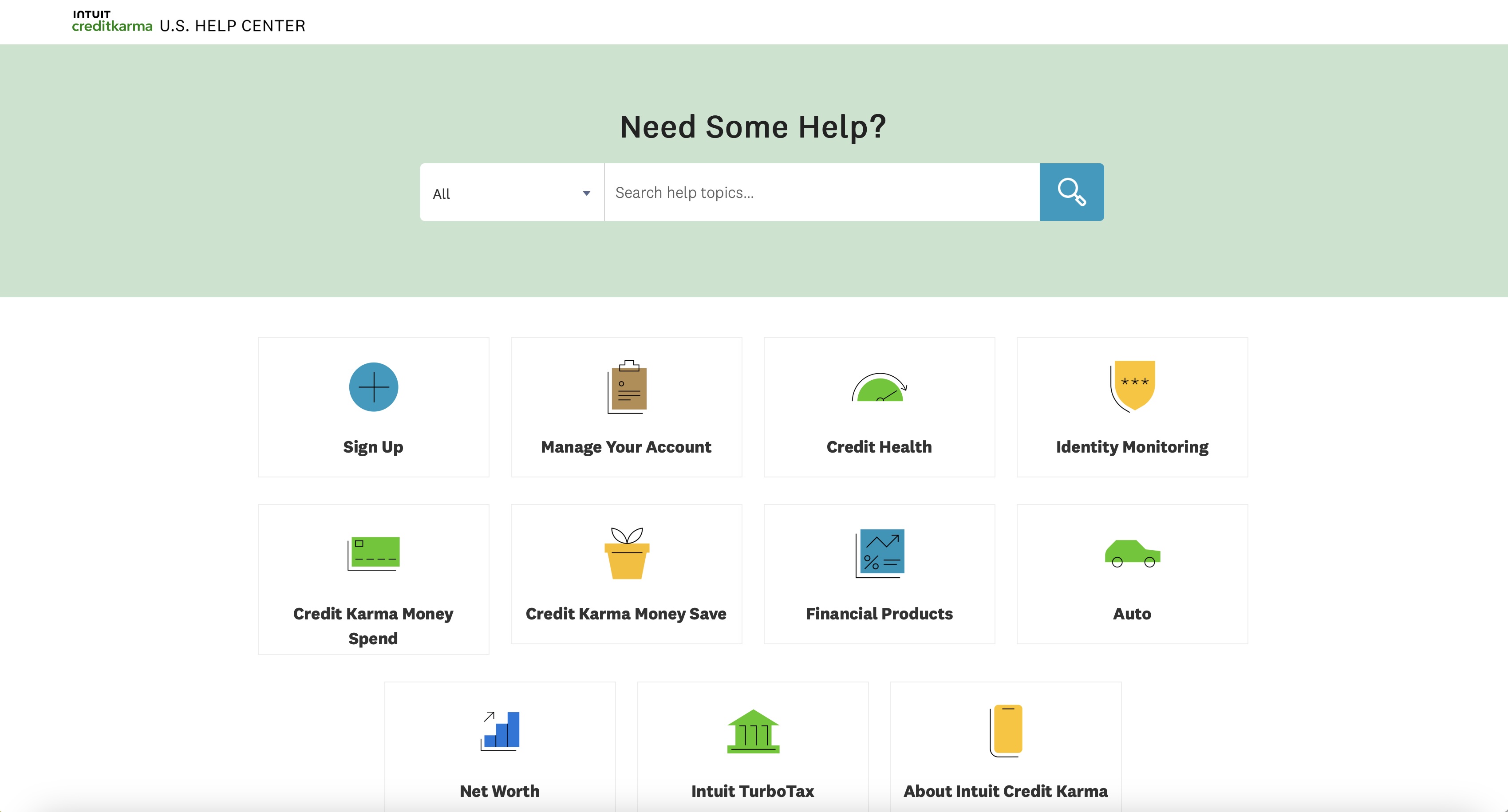

There’s not too much to go wrong with CreditKarma as the areas where it gives you an overview of your credit scores and the information relating to how that is shaped proves straightforward. In that respect, it seems unlikely that help will be needed for users dipping in and making the most of the free service. Anyone who does come unstuck is pointed to the Help Center, which is, in essence, an online portal offering predetermined answers to questions. It is comprehensive, mind.

CreditKarma: Final verdict

On initial inspection, CreditKarma is impressive enough with lots of tools that purport to help you better manage your personal finances. However, dig a little deeper and there are obviously lots of features and functions that have the potential to draw users deeper into the world of personal loans, offers of credit and other such schemes.

There’s nothing wrong with that per se, but anyone using CreditKarma who isn’t confident with their own financial management processes will want to tread carefully. It doesn’t cost anything to sign up, so CreditKarma is worth an experimental look. The comprehensive advice sections on the website could prove handy too, but there isn’t anything here that can’t be found elsewhere, as our best personal finance software guide attests only too well.

- We've also highlighted the best tax software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.