TechRadar Verdict

Monarch offers a seriously powerful package of features and functions designed to optimise personal finance returns. It’s also great for tracking funds, budgeting and planning for the future. There’s a sizable price to pay for the privilege, but as personal finance software goes, it’s up there with the best of them.

Pros

- +

A slick and powerful package

- +

Lots of versatility for power users

- +

Android and iOS apps are great

Cons

- -

Ongoing cost adds up

- -

Quite complex in places

Why you can trust TechRadar

When it comes to budgeting apps and personal finance software, lots of folks are drawn towards free or low-budget options. However, sometimes it’s worth spending more in order to enjoy a rather more premium experience. If you care about your finances, or they can be complicated and perhaps problematical too, Monarch could be an alternative.

This software, which is supported by excellent apps for both iOS and Android, has been evolving over the last few years and is now one of the most potent power tools you can own. While it packs many of those handy everyday features and functions that other budgeting and personal finance tools offer, Monarch also boasts options that can help make life easier when it comes to more complex money matters.

- Want to try Monarch? Check out the website here

However, there is indeed a cost for these extra power tools and Monarch is not the cheapest option out there in the financial software marketplace. It is possible to pay an annual fee, rather than going down the route of monthly payments, which makes the product slightly cheaper. Monarch, though, is essentially going to appeal to people who are very serious about getting their finances in order.

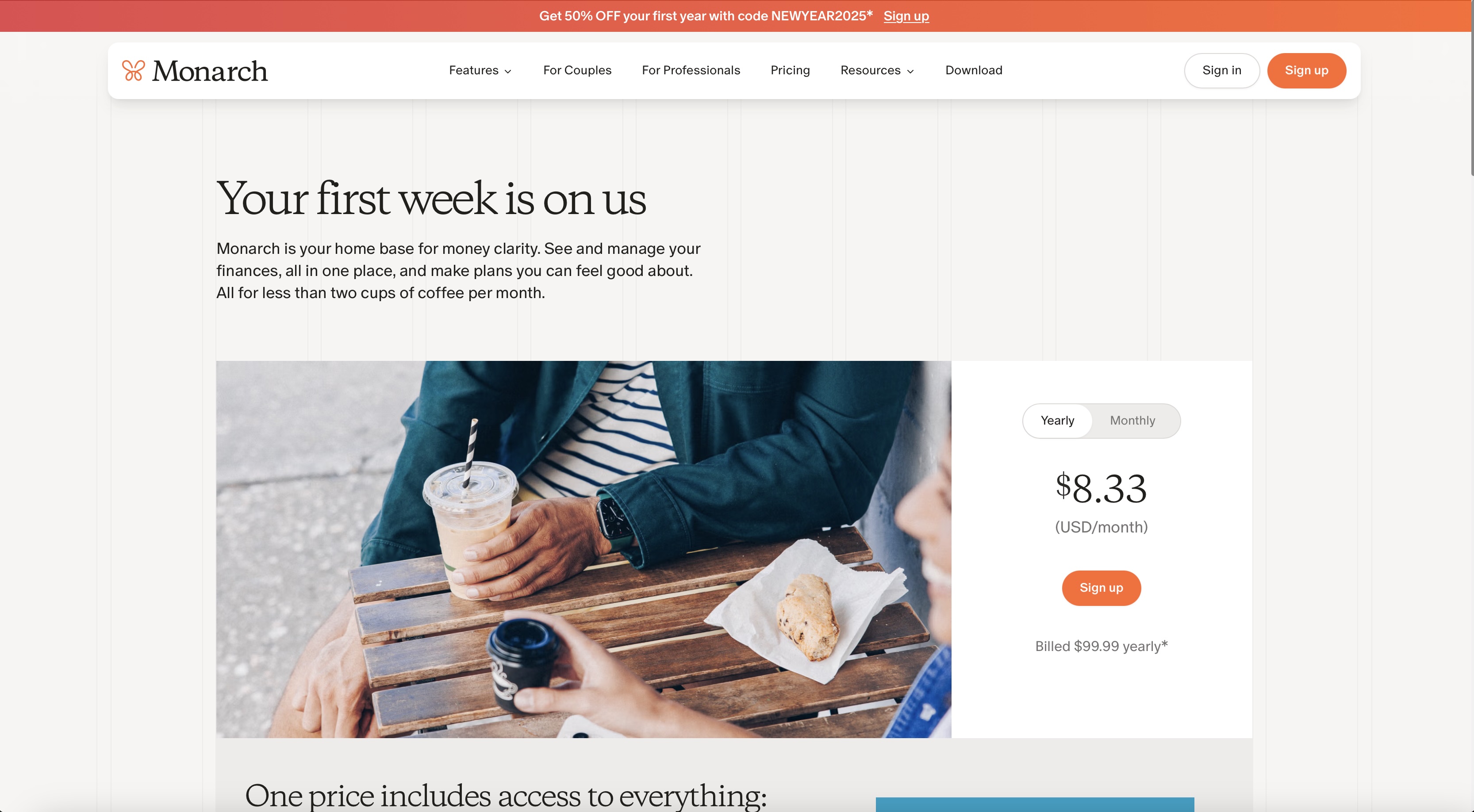

Monarch: Pricing

Anyone who has been used to enjoying their preferred personal finance and budgeting apps for very little outlay will find Monarch an altogether different proposition. Currently, it’ll set you back $14.99 per month, or there’s the annual payment option for $99.99, which equates to $8.33 per month over the course of a year, which shaves a little off the outlay.

In that respect, Monarch is a premium product and, thankfully, its features, functions and overall usability go a long way to justifying the higher price.

Monarch: Features

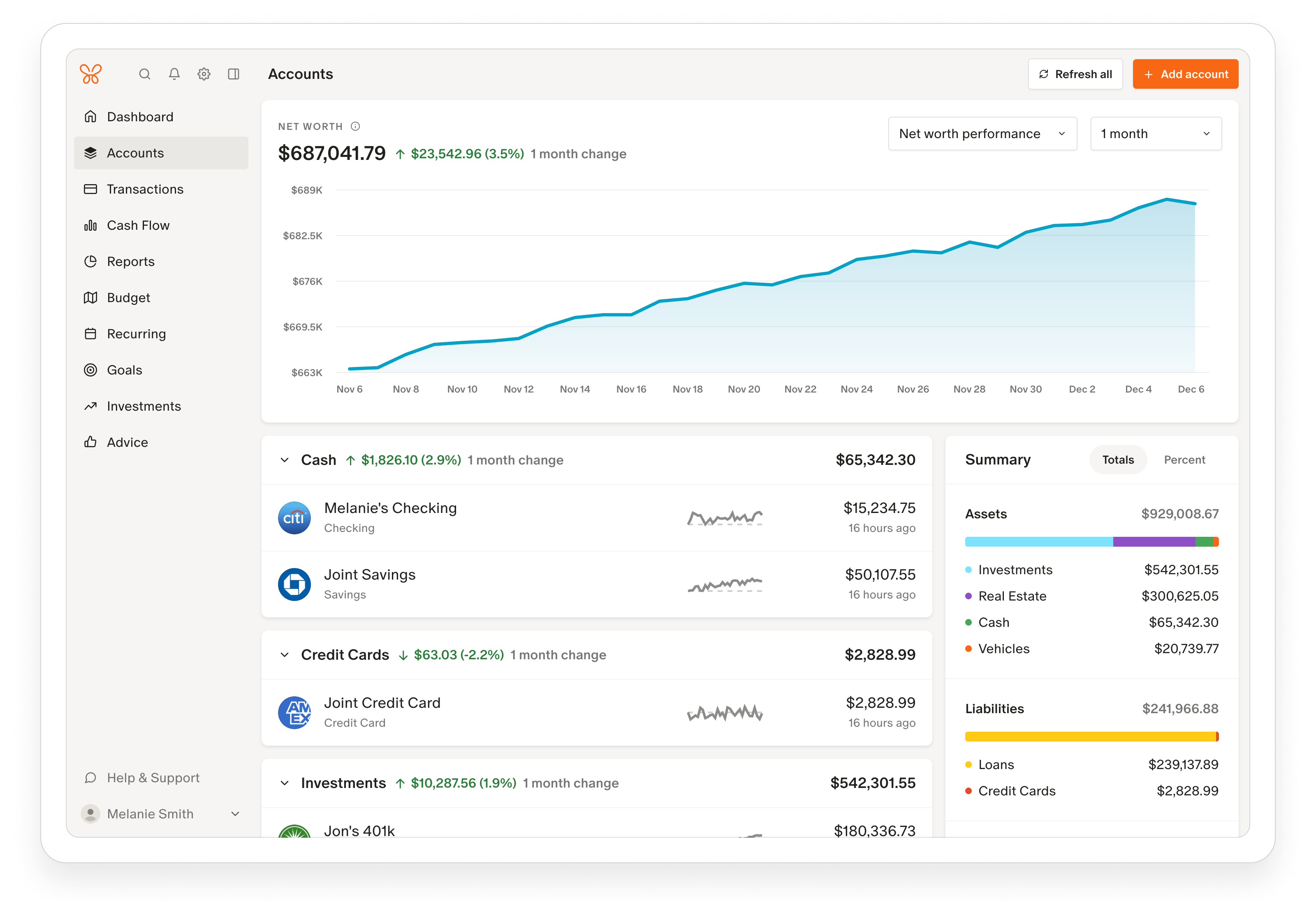

Monarch revolves around three core areas, all of which will be of interest to those with a keen eye on keeping their finances in order. First up is tracking, which, thanks to the powerful interface and ease of use, makes keeping tabs on all of your accounts in one handy location a big bonus of the personal finance app. There are tools for charting your net worth by pulling in data from bank accounts, real estate, investments and more.

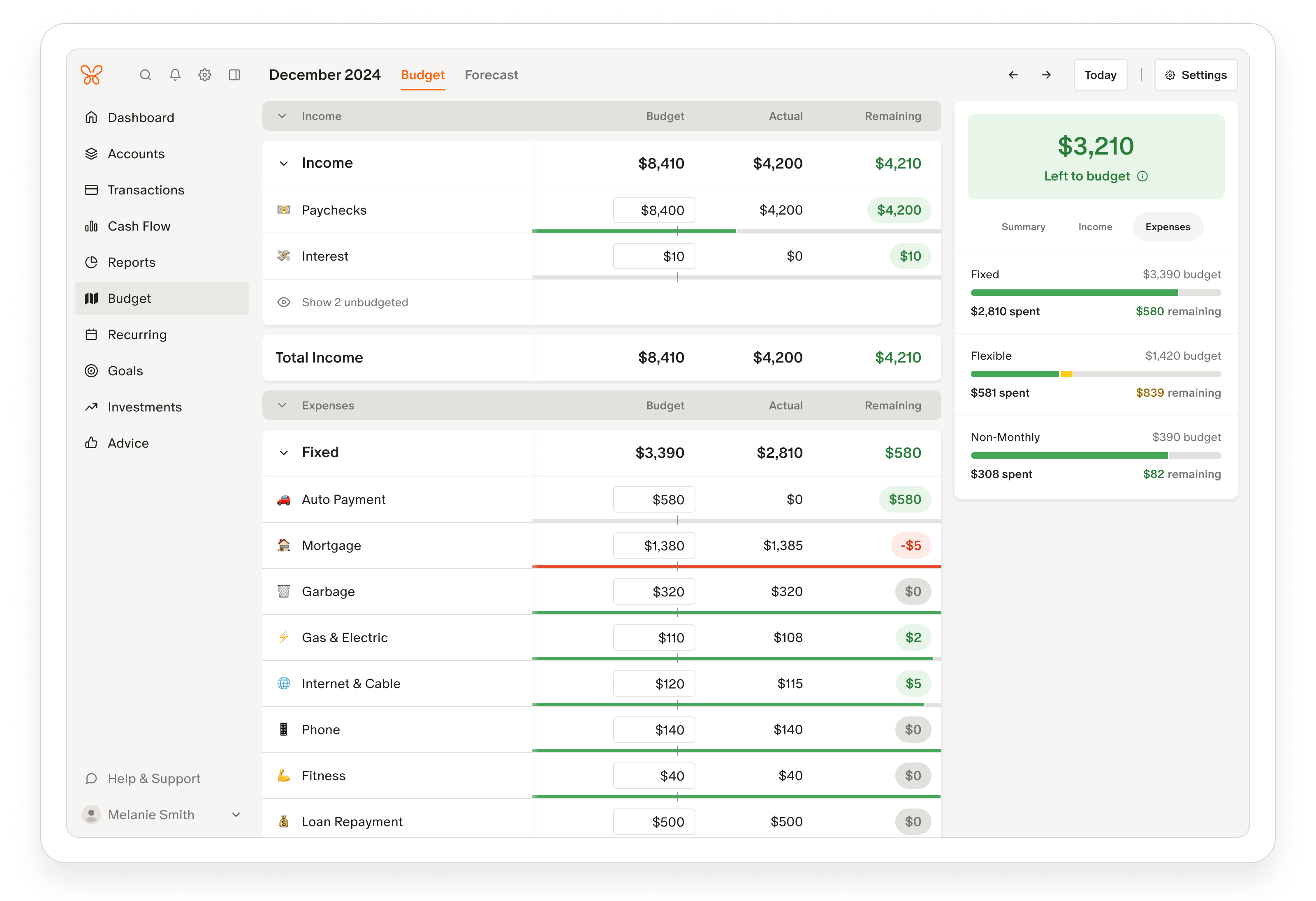

The next core component of Monarch is its budgeting capability. This Is not only powerful but a really well laid out aspect of the software. There are plenty of automated power tools, but the way everything is presented in delicious graphical colour makes the experience all the more impressive.

Following on from that is the third core component of Monarch and that revolves around planning and goals. Knowing what sort of shape your finances are in is one thing, but Monarch also offers lots of potential for planning for the future. Again, the way the graphics drive this section makes it a joy to use, while the power tools inside make working with your data simple but effective.

Monarch: Performance

Although there are app versions for iOS and Android, Monarch works best initially via a laptop where there is more space on screen to pick through the many and varied component parts. Again, the experience is a treat thanks to logical page layouts, great graphics and the clean, no-nonsense use of easy-to-read typefaces.

Monarch: Ease of use

Monarch is an easy thing to configure too, from linking bank accounts through to customising personal preferences. There’s even a helping hand given where it’s needed from AI elements. Better still, the way Monarch can be heavily tailored and personalised to suit your own financial situation makes it much more potent than many rivals. Transactions, in particular, is an area that can be tweaked and fine-tined with pinpoint precision.

Monarch: Support

While Monarch is very nicely designed, and beautifully thought out, there is plenty of help at hand should you need any support along the way. Some of the tools and functionality do take a while to explore and exploit to their full potential and a pick through the advice pages can prove to be highly beneficial. Outside of that, there are also options for messaging support services who should be able to help with anything not covered in the comprehensive and nicely laid out Monarch website.

Monarch: Final verdict

If you lament the demise of Mint, which was an excellent personal finance software tool, it’s well worth having a look at Monarch. Even more so when you consider some of the original team on Monarch also worked on Mint back in the day. The product has evolved a lot in recent years and now has plenty going for it, although that does come at a price.

It’s also interesting to note that the Monarch website has an area that allows potential users to compare it with YNAB, Simplifi, Credit Karma and, yes, Mint too. They’re all similar and obvious rivals, but Monarch holds its own, and then some.

- We've also highlighted the best tax software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.