What is Sprout.ai? Everything we know about AI insurance tool

Sprout AI is trying to make insurance claims faster and more accurate

Sprout.ai is an artificial intelligence company aiming to transform the insurance industry by automating claims processing.

Its advanced AI-powered platform enables insurers to make faster, more accurate claim decisions, reducing delays and improving customer satisfaction, at least in the majority of cases.

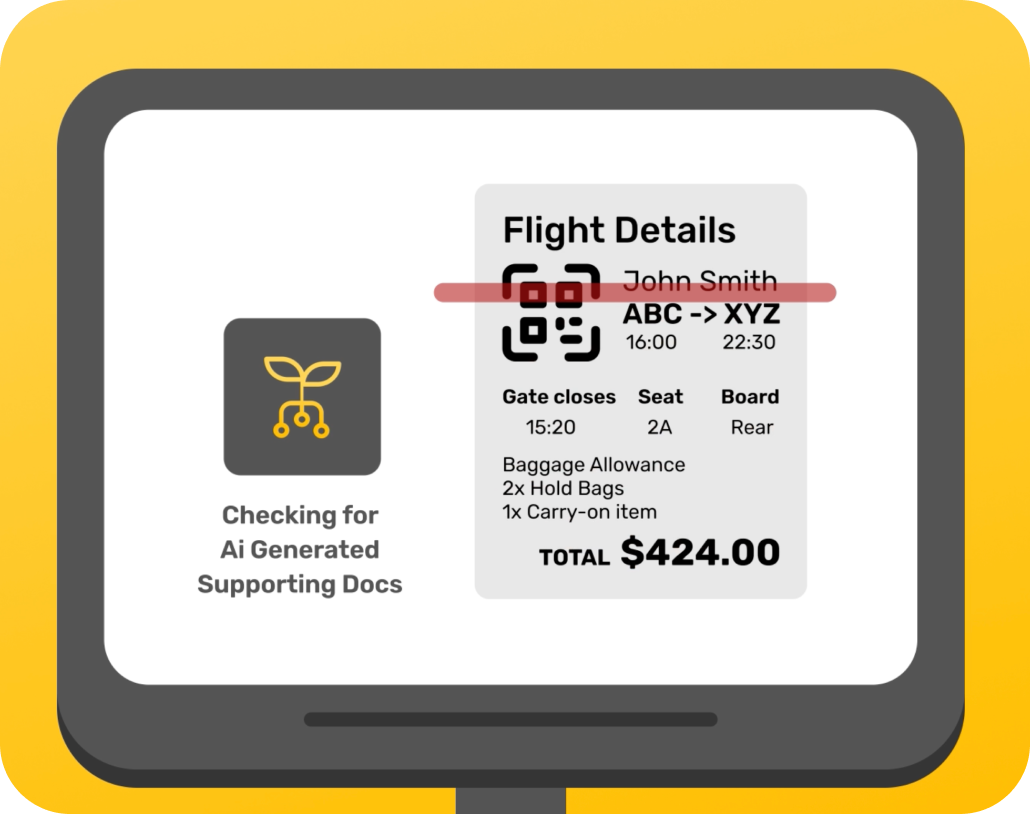

By integrating cutting-edge tech such as Natural Language Processing (NLP) and Optical Character Recognition (OCR), Sprout.ai helps insurers handle claims more efficiently, cutting settlement times from weeks to mere hours.

The company’s tools also reduce fraud risks and operational costs, making it a valuable tool for modern insurers looking to streamline workflows.

This article was correct as of February 2025. AI tools are updated regularly and it is possible that some features have changed since this article was written. Some features may also only be available in certain countries.

- Try out Sprout.ai

- The best AI tools around – ChatGPT, DeepL, Midjourney, and more

What is Sprout.ai?

Founded in 2018 and headquartered in London, Sprout.ai is an AI-driven claims automation platform designed to help insurers process claims faster and more accurately.

The company specializes in AI that streamlines claims management by automating tedious, manual processes.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

By leveraging Optical Character Recognition (OCR) and Natural Language Processing (NLP), Sprout.ai can extract, structure, and analyse claims data from unstructured documents such as invoices, medical reports, and policy statements.

Machine learning models help Sprout.ai assess claims information in real time, cross-reference policy details, and detect potential fraud. According to the company, its system can settle over 60% of claims in real-time while achieving a 96% accuracy rate in claims analysis.

This automation significantly improves efficiency, reduces operational costs, and allows insurers to focus their resources on complex claims requiring human intervention.

What can you use Sprout.ai for?

Sprout.ai is designed to streamline the insurance claims process by automating key tasks such as document analysis, fraud detection, and policy matching.

Its AI-powered system can extract and interpret unstructured data from invoices, medical reports, and contracts, ensuring claims are processed quickly and accurately and, ideally, with little human review.

According to Sprout.ai, over 60% of claims can be settled instantly, significantly reducing delays and administrative workload. The platform also enhances fraud prevention by identifying inconsistencies in claims data.

By minimizing manual intervention, insurers can allocate resources more effectively, focusing on complex cases that require human judgment while maintaining a smoother, more efficient claims process.

What can’t you use Sprout.ai for?

While Sprout.ai excels in automating insurance claims processing, it is not designed for tasks outside the insurance domain, such as coding, image generation, or serving as a general-purpose chatbot.

Additionally, its effectiveness depends on the quality of input data: poor-quality or incomplete documents may impact accuracy.

It is also not a customer-facing claims submission tool, meaning individual policyholders cannot use it directly to process claims. Instead, Sprout.ai functions as a backend solution for insurance companies, streamlining internal operations rather than providing a consumer-facing claims experience.

How much does Sprout.ai cost?

As an enterprise tool, Sprout.ai offers tailored pricing plans based on the specific needs and scale of the insurance company. Pricing details are not publicly disclosed and so interested parties are encouraged to contact Sprout.ai directly.

Where can you use Sprout.ai?

Sprout.ai’s platform is accessible through web applications, allowing seamless integration with existing claims management systems.

Its cloud-based infrastructure ensures that users can access the platform from various locations, facilitating flexibility and scalability for insurance companies operating in multiple regions.

Since it is designed for enterprise use, Sprout.ai is not available as a standalone consumer-facing app but rather as a B2B service that integrates into insurers’ existing claims processing workflows.

Is Sprout.ai any good?

While TechRadar Pro has not yet reviewed Sprout.ai, the company reports significant efficiency gains for insurers that use its AI platform. According to Sprout.ai, its claims automation achieves a 96% accuracy rate, and over 60% of claims can be settled in real-time.

This reduction in settlement times is particularly valuable, as 21% of customers expect claims to be resolved in hours, yet 43% currently wait more than two weeks.

Industry feedback highlights that Sprout.ai’s fraud detection capabilities add another layer of security, helping insurers mitigate risks. However, some users say successful implementation requires high-quality input data.

Use Sprout.ai if

- Your insurance company seeks to automate and accelerate the claims process, allowing claims to be settled faster while reducing operational costs.

- You need a solution that integrates seamlessly with existing claims management systems without requiring a complete overhaul. Sprout.ai’s cloud-based AI models allow insurers to enhance their current workflows while leveraging automation to scale operations.

Don’t use Sprout.ai if

- Your organization operates outside the insurance industry, as Sprout.ai is exclusively designed for automating claims processing.

- You are looking for a consumer-facing claims tool for individual policyholders. Sprout.ai is built for insurers, not end users, meaning customers cannot submit or track claims directly through its platform.

Also consider

If you’re exploring alternative AI-driven solutions for the insurance industry, there are several other platforms worth considering.

EasySend is an insurtech platform focused on digitising and automating paperwork-heavy processes. It enables insurance companies to transition from traditional claims documentation to fully digital, automated workflows.

Vitesse provides treasury and payment solutions tailored for insurers, ensuring that claim payouts are processed efficiently and securely. If payments are a bottleneck in your claims process, Vitesse offers a financial automation layer to improve cash flow and settlements.

Want to read more about Sprout.ai?

Max Slater-Robins has been writing about technology for nearly a decade at various outlets, covering the rise of the technology giants, trends in enterprise and SaaS companies, and much more besides. Originally from Suffolk, he currently lives in London and likes a good night out and walks in the countryside.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.