TechRadar Verdict

AllClear ID sends out some really unclear signals. It starts with a confusing website to barely explain what the product even does, on to an enrollment process that makes the assumption your employer provided a free code, and ends with a lack of clarity about the services provided. Overall, it makes this a tough sell. At a mere $8.50 per month, it seems like a bargain. However, upon further inspection, you realize that most other identity theft protection apps provide better information and guidance- both on the website and in the application itself.

Pros

- +

Really low price

- +

Phone support

Cons

- -

Confusing website

- -

Minimal info on features

- -

No smartphone apps

- -

No free trial

- -

Minimal support options

Why you can trust TechRadar

Our series on identity theft protection apps will evaluate the features, pricing options, competition, and also the overall value of using each app. However, these are not full hands-on reviews since evaluating identity theft protection apps is almost impossible. It would require several months of testing, purposefully hacking accounts to see if the protection app works, handing over personally identifiable information, performing multiple credit checks, and risking exposure of the reviewer’s personally identifiable information.

The worst thing you can experience is confusion when trying to select an identity theft protection app. After all, there is already enough anger and chaos over being hacked, and losing access to a bank account. There’s the anxiety about damage to your credit history and credit score. These days, cybercriminals can easily cause devastation and heartache, not to mention being in the middle of the pandemic. Let’s face it, there’s really no good time to have to deal with identity theft.

Against that background, AllClear ID is an uber frustrating product. While the low price is tempting, consumers may have the temptation to sign up. After all, what’s the downside? Well, the website for this product hardly supplies the guidance you would need to make a quality decision. There was previously a choice of plans, now there is just one for an individual, and the prior free plan is also no more. You just see a basic laundry list of what is available on the single tier of plan, without any further detail.

Even worse, the product is set up for those who have a code from an employer who provides AllClear ID as part of its benefit package. (A report in Tom’s Guide from 2016 does mention that the non-employer version doesn’t even work anymore.) The website and app feature the bare minimum in details about the available protection, and a blog offering financial and online protection guidance gives a vibe of being too generic. (Here’s one featuring voice assistants that overflows full of blanket statements sprinkled with fear-mongering, and short of any actual details.)

Plans and pricing

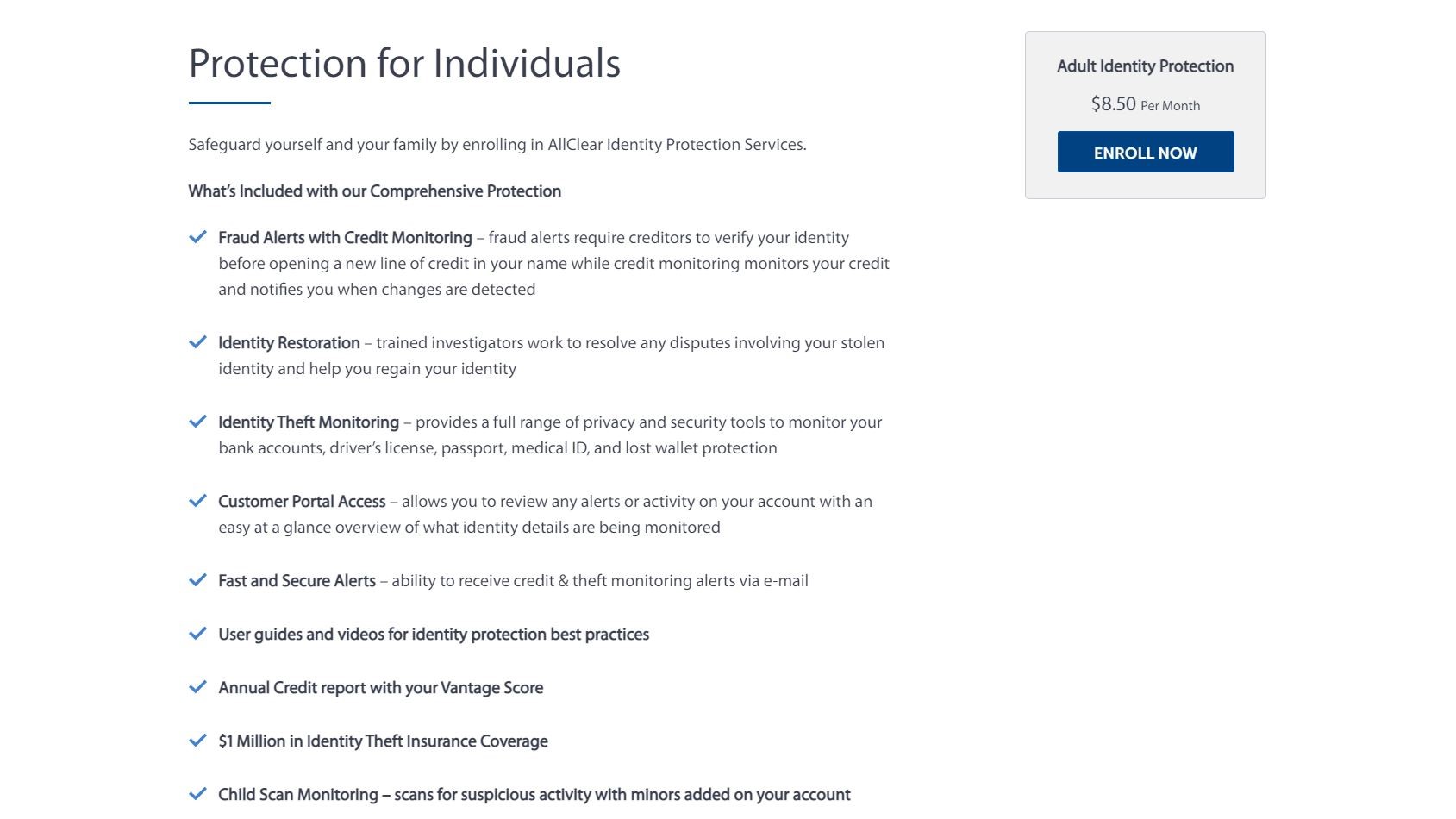

AllClear ID offers a single plan for individuals, but just has a laundry list of features without any real specifics. The only other plan is for businesses, for an employer to provide as a benefit. Adding to the confusion, when you go to register as an individual, before they even take your basic demographic info, AllClearID just gives options to pay, Google Pay or a credit card with a price of $8.50/month. There is no option to pay annually for a discount, or to add a family member for a group price.

Interface

The website has a clunky interface that looks like 1998 has called and wants its website back. It has bright blue links on a white background, it is work to figure out what to click on, and how the features will work. We’re decades away from the step-by-step guidance of Norton LifeLock with its wizards, which clearly displays the status of identity protection via its clean and professional interface.

There’s a deficit in the product for clear information on the company website and within the app, and we’re used to seeing more on a photo editing app. This is even more of an issue when we realize that we’re talking about a highly personal problem if you are an identity theft victim. Also not reassuring is that the AllClear ID website seems to emphasize its other product, AllClear Health ID that is designed for the important issue of correct patient identification, and to reduce patient mismatches. However, this has nothing to do with credit protection, so it is not like the two products provide any real synergy.

Features

AllClear ID offers the routine standard features you would expect of a credit protection provider. There’s the typical fraud alerts (but no explanation of how they work or what they are tracking). You receive features such as Fraud Alerts with Credit Monitoring (although it is not clear if it is all three credit unions or only one), an Annual Credit report with your Vantage Score (although no detail what that is, we had to research it separately here), and $1 Million in Identity Theft Insurance Coverage (at least that’s clear). There’s also a feature called ChildScan Monitoring but the explanation of “Scans for suspicious activity with minors added on your account,” leaves us with as many questions as before we read the sentence.

We also looked for smartphone apps, both for Android and iOS. We did not locate an AllClear ID app for either platform, which is not reassuring.

Support has a single option for contact. It is via phone, and open 12 hours daily; it is not stated if it is closed on weekends and holidays, or open 365 days a year. There are no other options listed for an email, chat, or any other option, nor did we find any self help content, such as a FAQ, forum or articles.

The competition

There is no shortage of competition in the crowded identity theft protection field. AllClear ID fails to make a case for itself, and does not compare favorably with any of the other apps currently available. By way of comparison, Norton LifeLock provides far more information about the features available, and a well thought out interface that does plenty of handholding along the way. Another competitor, Complete ID is also similarly priced if you are already a Costco member. Even the apps from Equifax and Experian end up more compelling, despite both companies having previous data breaches, because at least each spells out which features are available and what the product can do.

Final verdict

As is undoubtedly clear by now, AllClear ID has its issues. It’s confusing to figure out what the features do, and it’s no better even if you have an enrollment code from your employer. The interface overall is fairly old and clunky, like a second rate tax program from the 90s. The support is too minimal for our taste, and too many details are left amorphous.

In the event you need to resolve an identity theft issue, AllClearID doesn’t spell out what will happen. Confusing features like ChildScan Monitoring may be of some help, but it’s not clear what it specifically accomplishes. The wording on the website is even confusing as one feature listed is Fast and Secure Phone Alerts- it sounds like you will receive alerts on your phone but who knows the nuts and bolts of it? As it isn’t clear, it leaves us wondering. In the end, it could make identity theft even more confusing than it already is, and hence we would recommend to check out other options than this one.

We've also highlighted the best identity theft protection

John Brandon has covered gadgets and cars for the past 12 years having published over 12,000 articles and tested nearly 8,000 products. He's nothing if not prolific. Before starting his writing career, he led an Information Design practice at a large consumer electronics retailer in the US. His hobbies include deep sea exploration, complaining about the weather, and engineering a vast multiverse conspiracy.