TechRadar Verdict

Checkmyfile won't automatically alert you to signs of identity theft, but its smart multi-agency report makes it easier to spot them yourself.

Pros

- +

Combines data from four credit agencies

- +

Helpful graphs and charts

- +

Password-protected PDF downloads

Cons

- -

No automated alerts

- -

Report can seem complex

Why you can trust TechRadar

Signing up for a typical UK-based identity theft protection service will give you access to your credit report, but only from one credit agency – usually Experian, Equifax or Callcredit. These are usually very similar, but there are likely to be differences.

Checkmyfile takes this to the next level, combining your credit report details from Experian, Equifax, Callcredit and Crediva to give you a much more rounded picture of what's held about you online.

What you don't get with Checkmyfile are any form of automated alerts when your credit reports change. That's perhaps understandable – deciding when to raise alerts is going to be much more complicated when you're looking at four reports rather than one – but it does mean that if you want to use Checkmyfile to detect identity theft, you'll have to do it yourself.

This isn't necessarily a fatal problem. Yes, using Checkmyfile for identity theft protection requires more work than competing services. But if combining reports from four agencies allows you to spot something that other services might miss, you could still be better off overall.

If you do fall victim to ID fraud, Checkmyfile provides a free assistance service to help you recover. This is relatively limited – the company will advise you what to do next, but you'll have to contact providers yourself, and there's no insurance against losses – but if the worst happens, that will still be worth having.

A free 30-day trial provides a risk-free way to check out Checkmyfile’s abilities, and after that, pricing is almost identical to the big-name UK competition at £14.99 a month.

- We tell you how to check if your identity has been stolen

Reports

Signing up with Checkmyfile takes a while, as the company uses multiple techniques to check and verify your identity. We were asked for our name, date of birth, email address, physical address, the date we moved in, and the names of one or two credit card, loan, mobile phone or mortgage providers we might have.

This might seem tedious, but we prefer to think of it as 'thorough'. Your credit reports are packed with sensitive information so it's vital to ensure that no-one can access them but you, and Checkmyfile’s quizzing does an above-average job of keeping your data safe.

Most credit reporting sites open with a very basic summary of your finances, and leave you clicking on buttons or panels to drill down into specific areas. Checkmyfile does things a little differently. Log in and you're immediately presented with a very lengthy and detailed credit report.

Part of this complexity is down to the way Checkmyfile works. Sign up with Experian and you'll only see the details from Experian's own credit report. The value of Checkmyfile is that it combines the reports of Callcredit, Crediva, Equifax and Experian, which means the site has more information to show you than anybody else.

This makes the report look a little intimidating, at least initially, as you browse four text panels listing the key areas of each credit report. But scroll down and the text-heavy approach is replaced by something much more interesting.

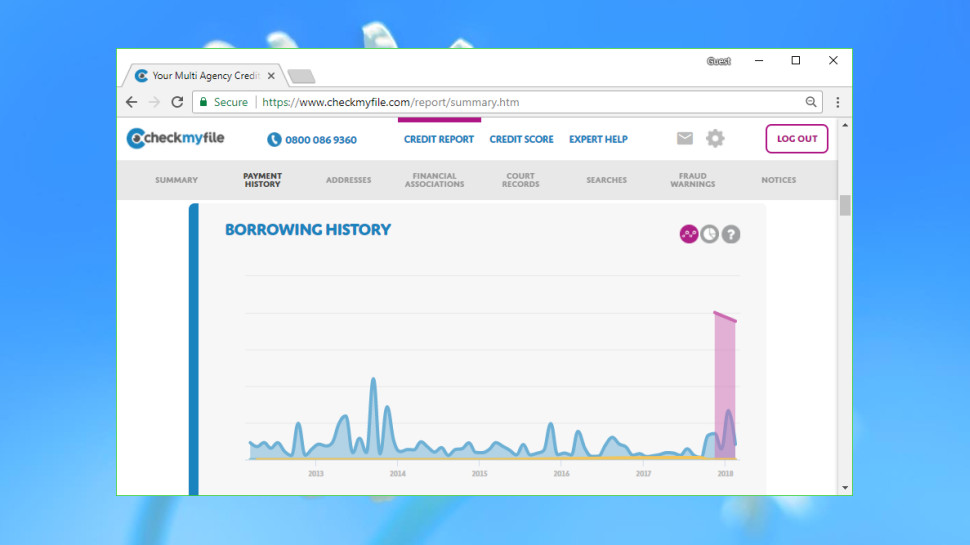

For example, a Key Account Dates chart shows a graphical timeline of your finances, highlighting when you've opened or closed particular accounts. No need to scroll through complex tables, just click a date on the timeline to see the account and the source credit agency.

Elsewhere, a bar chart highlights search activity on your account over the last 12 months. Other reports typically display this data as a text table, forcing you to read every detail before you can understand it. But Checkmyfile’s more visual approach instantly shows you when searches have clustered together, which could (if you can't explain them) indicate someone trying to apply for financial products in your name.

Checkmyfile isn't just about the visuals: there's real data here, too. The Payment History section lists all your open and closed accounts, and highlights any that are visible on some credit reports and not others. The account type (bank, loan, credit card, more) and balance are listed upfront, and month-by-month payment and balance histories are just a click away.

Checkmyfile's key selling point is its use of credit reports from four agencies, but how much value does this really have? Our report did show some small but significant differences. Callcredit had one active account that others missed (a utility provider), plus Equifax and Experian listed a credit application where Callcredit didn't.

Also, Equifax made smarter use of the electoral roll to identify both our current and previous address. We can't predict what might be on your report, but it's at least possible that you'll get useful extra information from Checkmyfile that you won't see elsewhere.

Unlike most of the competition, there are no automated ID fraud warnings. Checkmyfile won't alert you when your credit score or report changes, and there's no option to search the web for your personal or financial details.

You could use the service to check for issues manually, though, and Checkmyfile does its best to help. The company doesn't just give a web view of your report, for instance: you can download the core details in a PDF, making it easy to save local copies and compare them later.

We've seen other services do something similar, but Checkmyfile wins out for its attention to detail. Its reports are properly formatted into individual pages, so tables don't start on one page and finish on the next, as often happens elsewhere. And Checkmyfile’s PDF reports are automatically password-protected, reducing the chance of exposure if snoopers (or malware) find the documents later. That's a sensible move, but not something you'll see with most of the competition.

Final verdict

Checkmyfile isn't a specialist identity theft protection service and won't automatically warn you of potential problems. But if you're happy to run manual checks, its well-designed report combining data from four agencies does make it more likely that you'll spot issues yourself.

- We’ve chosen the best identity theft protection solutions of 2018

Mike is a lead security reviewer at Future, where he stress-tests VPNs, antivirus and more to find out which services are sure to keep you safe, and which are best avoided. Mike began his career as a lead software developer in the engineering world, where his creations were used by big-name companies from Rolls Royce to British Nuclear Fuels and British Aerospace. The early PC viruses caught Mike's attention, and he developed an interest in analyzing malware, and learning the low-level technical details of how Windows and network security work under the hood.