TechRadar Verdict

Experian IdentityWorks, tailored for everyday users, is a robust identity theft protection application. It stands out with its comprehensive educational resources, featuring a blog with a plethora of informative articles. However, some may be hesitant to use the app due to Experian's involvement in a significant data breach in 2015 that affected 15 million accounts. Nevertheless, Experian IdentityWorks remains a well-rounded and valuable tool for protecting personal information.

Pros

- +

Helpful website

- +

Extra alerts are useful

- +

Free trial offer

- +

Discount for paying annually

Cons

- -

Only two paid tiers of plans

- -

No dedicated app for smartphone

- -

Trial offer is only a week

- -

Customer support contact options too limited

Why you can trust TechRadar

Our series on identity theft protection apps will evaluate the features, pricing options, competition, and also the overall value of using each app. However, these are not full hands-on reviews since evaluating identity theft protection apps is almost impossible. It would require several months of testing, purposefully hacking accounts to see if the protection app works, handing over personally identifiable information, performing multiple credit checks, and risking exposure of the reviewer’s personally identifiable information.

Despite the passage of time, virtually all reviews and news articles about Experian IdentityWorks commence with the same disclaimer about the data breach. This assessment is no different, yet it's debatable if that's entirely just. IdentityWorks, a brand you might not recognize, is a subsidiary of Experian, a name you may be familiar with, albeit not for favorable reasons. In 2015, this consumer credit reporting agency disclosed one of the most prominent data breaches up to that point, leading to the leak of over 15 million customer records. While there have been subsequent data breaches, perhaps the irony of a credit reporting agency suffering a significant breach is what garnered global attention.

More than a decade has passed since the incident in question. Serious movie enthusiasts will recognize this reference, but it may also remind some of a scene from The World According to Garp, where Robin Williams plays a character in search of a home. Unexpectedly, a plane crash-lands in the living room, and Williams' character decides to buy the house. He reasons, "The chances of another plane hitting this house are astronomical." The same logic applies here. Experian has likely taken steps to improve its data security more than most companies, and one could argue that the chances of another major data breach are, at best, "astronomical."

Reader Offer: Save up to 50% on Aura identity theft protection

TechRadar editors praise Aura's upfront pricing and simplicity. Aura also includes a password manager, VPN, and antivirus to make its security solution an even more compelling deal. Save up to 50% today.

Preferred partner (What does this mean?)

Experian IdentityWorks: Plans and pricing

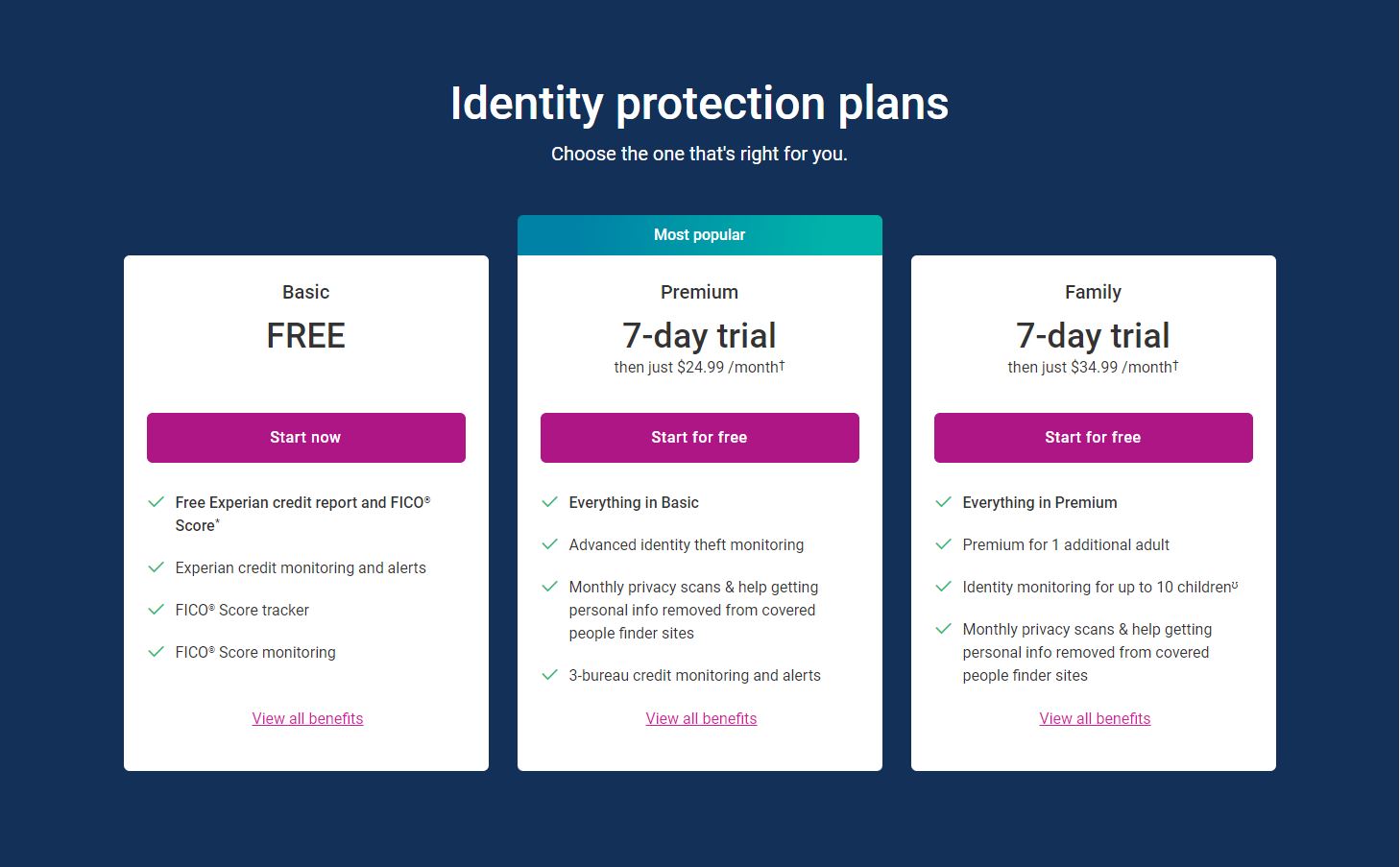

The Basic plan, a free tier of Experian, offers limited features. It includes a complimentary Experian credit report, FICO score, dark web surveillance report, and FICO score tracker. While cost-effective, this plan provides minimal protection.

The Premium plan offers a comprehensive range of features designed to protect adults from identity theft and fraud. Priced at $24.99 per month, this subscription service provides robust monitoring and alerts to safeguard sensitive personal information.

One of the key features of the Premium plan is 3 bureau credit monitoring. This service monitors your credit reports from the three major credit bureaus—Experian, Equifax, and TransUnion—and notifies you of any changes or suspicious activity. This allows you to stay informed about your credit profile and quickly identify any potential issues, such as unauthorized inquiries or fraudulent accounts.

To enhance account security, the plan offers financial account takeover alerts. These alerts vigilantly monitor your financial accounts for any unauthorized transactions or changes. By doing so, this feature safeguards your bank accounts, credit cards, and investment accounts against potential compromises. If any suspicious activities are detected, you will receive immediate notifications, allowing you to take prompt action to secure your accounts effectively.

Within the Premium plan's robust offerings, change of address alerts stand out as a crucial feature. This service keeps a watchful eye on public records to detect any modifications to your address, such as alterations to your driver's license or voter registration. Identity thieves frequently exploit change of address requests to reroute your mail, allowing them to pilfer confidential documents. However, this alert system safeguards you by promptly notifying you of any unauthorized changes, empowering you to take proactive steps to shield your identity from harm.

In addition to its monitoring features, the Premium plan provides social network monitoring alerts. This service vigilantly scans social media platforms for any unauthorized use of your name, photos, or personal information. Given that social media accounts are frequent targets for identity thieves, this alert system keeps you informed of potential online fraud attempts.

Among the many benefits of the Premium plan, the most notable feature is the up to $1 million in identity theft insurance it provides. This coverage acts as a financial safety net in the unfortunate event you become a victim of identity theft. The insurance covers expenses associated with restoring your identity, including legal fees, lost wages, and credit repair. This coverage offers invaluable peace of mind, knowing that you have a support system in place to help you recover from the devastating impact of identity theft.

The Premium plan provides a comprehensive array of security features to safeguard adults from identity theft and fraudulent activities. This subscription service offers robust monitoring, timely alerts, and substantial insurance coverage, creating an invaluable layer of protection for your sensitive personal information.

For families with more than one adult, the top-tier Family plan is the best choice. With a monthly cost of $34.99, this plan covers two adults and up to ten children, offering all the features of the Premium plan except for one minor difference.

The assumption of identity theft prevention software that users could have "up to" 10 children is perplexing, particularly given that the average number of children per family in the US is only two, and even fewer in the UK. Despite this, IdentityWorks inexplicably offers pricing options that accommodate up to 10 children and one or two adults. This pricing structure stands in stark contrast to the reality of family sizes in most countries and raises questions about the rationale behind such an assumption.

Regrettably, annual discounts are unavailable at this time. Instead, a brief 7-day free trial is offered. However, it necessitates purchasing the plan and then canceling it within the trial period, effectively converting it into a money-back guarantee during the first week.

Experian IdentityWorks: Interface

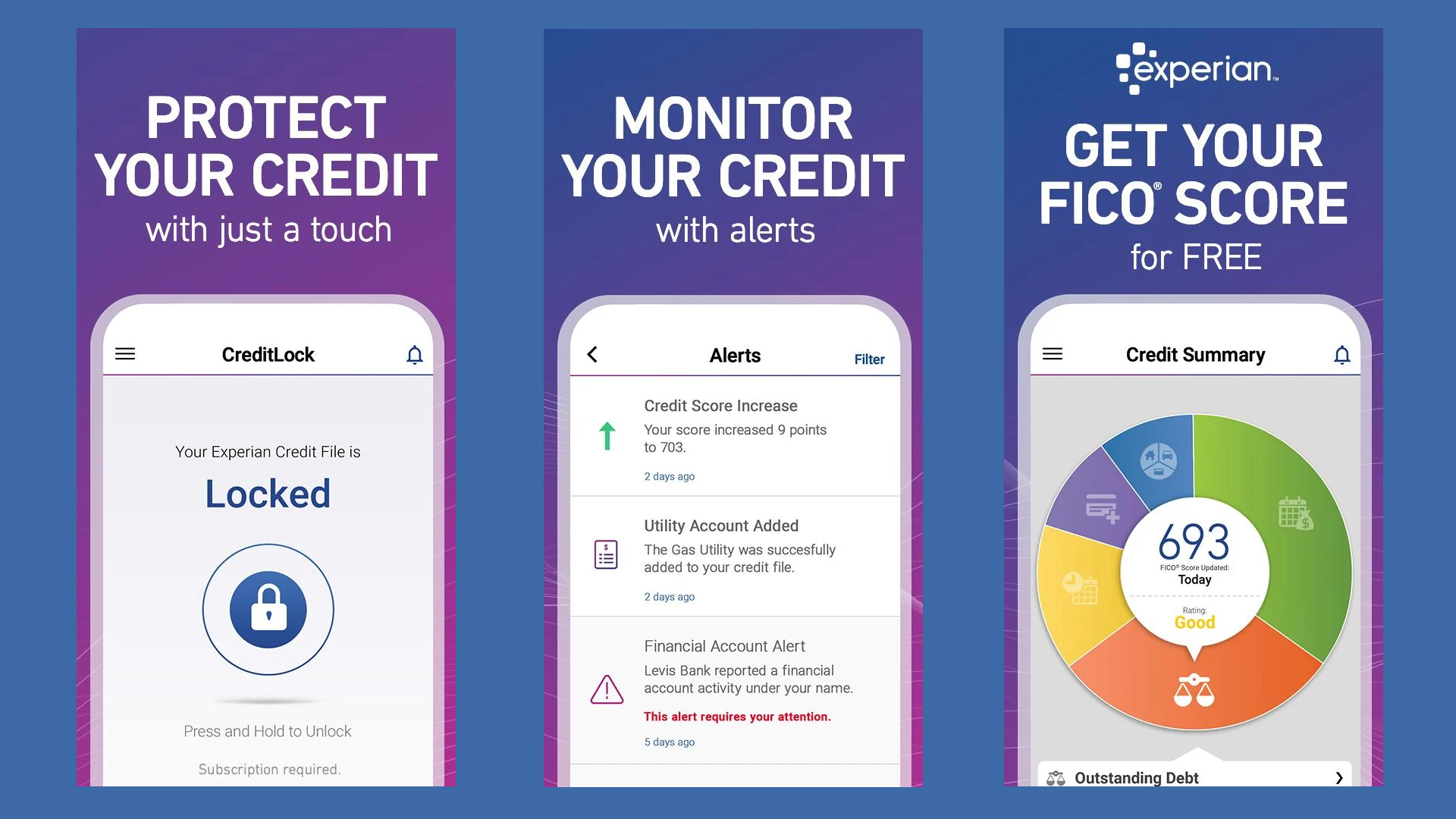

Thank goodness we're working with a major corporation like IdentityWorks, which has the resources to create a user-friendly and feature-rich app. IdentityWorks' dashboard features a minimalist design with tabs at the top, making it easy for users to navigate and find the information they need. The dashboard also includes a wizard that shows users how many steps they've completed and how many accounts they've configured, much like how Norton LifeLock presents everything in a straightforward and accessible way.

In contrast to PrivacyGuard, IdentityWorks' interface is clean and understated, giving users the impression that they are working on something important rather than playing a game. PrivacyGuard's website and app have a bit too much color, which can be distracting and overwhelming for some users.

IdentityWorks' app also includes a number of features that make it easy for users to manage their identities and protect their privacy. For example, users can use the app to create strong passwords, monitor their credit reports, and receive alerts about potential identity theft. The app also includes a variety of tools that can help users recover their identities if they are ever stolen.

Overall, IdentityWorks is a great option for users who are looking for a comprehensive and easy-to-use identity management solution. The app's clean interface, user-friendly features, and robust security make it a top choice for anyone who wants to protect their identity and privacy online.

While the Identity Works website provides links to Android and iOS apps, many consumers are unaware of their existence. Unfortunately, the linked apps are for the Experian app, not a dedicated IdentityWorks app. This oversight is disappointing for consumers seeking a comprehensive identity management solution.

Experian IdentityWorks: Features

While Experian boasts a vast library of threat detection information on their website, app, and through hundreds of blog posts, IdentityWorks sometimes overlaps functionality offered by Norton LifeLock and similar products. You can monitor your credit, check your score, receive alerts about potential identity theft attempts, and even be notified of nearby registered sex offenders – all fairly common features. However, IdentityWorks does differentiate itself with a few unique offerings.

Verification of court records is a unique feature of IdentityWorks that sets it apart from other programs. You will be notified if there are any changes or updates to your court records (if they exist). Additionally, IdentityWorks offers a more accurate simulation of credit checks and FICO scores. The frequency of access to these credit checks differs between the Premium and Family versions. With Premium, you can check your daily FICO credit score. On the other hand, with Family, you receive a daily Experian credit report, which may be more frequent than some users need.

Experian IdentityWorks: The competition

In the realm of identity theft protection, Norton LifeLock stands as a prominent rival to Experian. Those familiar with the industry are well aware of LifeLock's leadership position, with Experian also being a recognizable name. While Experian primarily operates as a credit reporting organization, Norton emphasizes security. This distinction grants Norton an advantage in addressing various ways individuals' credit can be compromised, whether through their own actions or by malicious external entities. However, potential users face a choice regarding their primary concern – safeguarding their identity and reputation from theft or protecting their creditworthiness to facilitate significant purchases like homes or cars. Though both aspects are equally vital, users must carefully consider the product they select to align with their specific needs.

Experian IdentityWorks: Support

Experian doesn't provide a specific phone number or email address for direct contact regarding issues. Instead, clicking on "Contact us" directs users to a help center with various articles. For immediate assistance, Experian recommends obtaining an Experian credit report and calling the phone number provided on the report.

To enhance user satisfaction, we would suggest more streamlined and accessible communication channels for users to reach out to Experian.

Experian IdentityWorks: Final verdict

In today's digital age, safeguarding personal identity has become paramount. With the proliferation of online transactions, social media platforms, and interconnected devices, our personal information is more exposed than ever before. While credit protection is essential, it only addresses a limited aspect of the potential risks associated with identity theft.

Identity theft encompasses a wide range of fraudulent activities that can have devastating consequences for victims. Criminals can use stolen personal information to open credit accounts, apply for loans, file fraudulent tax returns, or even commit crimes in the victim's name. The impact of identity theft can extend far beyond financial loss, as it can damage credit scores, harm reputations, and lead to emotional distress.

Experian IdentityWorks is one of the leading identity theft protection services available. It offers a comprehensive suite of features designed to help individuals safeguard their personal information and mitigate the risks of identity theft. These features include credit monitoring, fraud alerts, identity theft insurance, and access to a dedicated fraud resolution team.

Experian IdentityWorks' teaching materials are particularly noteworthy. These materials provide valuable information on identity theft prevention and best practices for protecting personal information. The materials are presented in a clear and engaging format, making them accessible to individuals of all ages and backgrounds.

Ultimately, the decision of whether or not to use Experian IdentityWorks is a personal one. Those who are primarily concerned with their finances and credit may find Experian IdentityWorks to be a smart alternative to other identity theft protection services. However, customers who are concerned about Experian's past data breach may want to consider other options.

We've also highlighted the best identity theft protection

John Brandon has covered gadgets and cars for the past 12 years having published over 12,000 articles and tested nearly 8,000 products. He's nothing if not prolific. Before starting his writing career, he led an Information Design practice at a large consumer electronics retailer in the US. His hobbies include deep sea exploration, complaining about the weather, and engineering a vast multiverse conspiracy.