TechRadar Verdict

FreeAgent provides an attractive online bookkeeping solution, designed to manage projects, send and track invoices, and organize expenses. While the cost is not ideal for a sole proprietorship, for larger small businesses we find it a good deal.

Pros

- +

Free trial

- +

Unlimited number of clients

- +

Simple account setup

- +

Comprehensive invoicing tools

Cons

- -

Single tier in US only

- -

Expensive for sole proprietor

Why you can trust TechRadar

Accounting is one of those necessary evils in life. You know, the sort of thing that needs to get done, but nobody really likes dealing with it. After all, who really wants to keep track of that pile of invoices, submitting them in the hopes of getting paid in a timely fashion, and resubmitting them as they remain unpaid. If you are not careful, this can really cut into the main focus of the business, and become a serious time and workforce sink, and small businesses face the difficulty of not having a dedicated accounting department.

Enter UK-based FreeAgent, which offers accounting software focused on the challenges of small business accounting. Their origins stretch back over a decade ago to 2007 when three freelance developer/developers, frustrated with the “mess and stress of bookkeeping,” put their expertise to use to tame the mountains of receipts and spreadsheets.

Today, FreeAgent has grown to a team of 170, and has helped over 70,000 small business, freelancers and their accountants with their bookkeeping needs. In fact, the company grew so much, that it was acquired by the Royal Bank of Scotland Group last year, although FreeAgent maintains operational independence.

- Want to try FreeAgent? Check out the website here

FreeAgent: Pricing

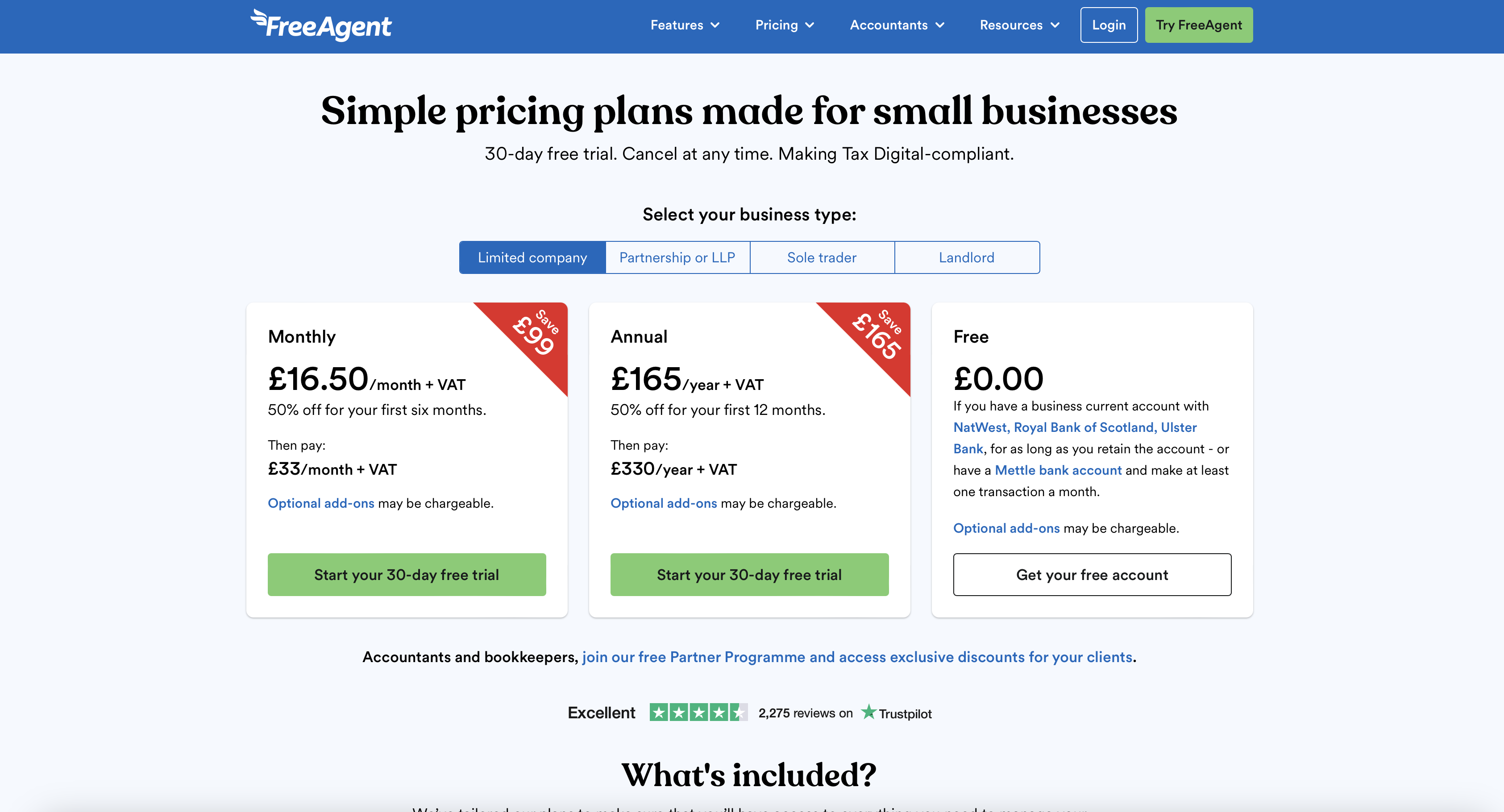

Many online software offerings bombard the user with a gaggle of tiers to suit every need with varying features at different price points. Still others go with the opaque pricing forcing the user to call and build a custom plan just to get an idea of the price. A third strategy is a free tier, that is severely limited in some way that then forces the user to upgrade once they realize the fatal flaw.

FreeAgent does a bit of everything by offering a single tier, If you have a business current account with NatWest, Royal Bank of Scotland, Ulster Bank, for as long as you retain the account - or have a Mettle bank account and make at least one transaction a month.

For the UK, Freeagent then has monthly or annual different options to choose from. For example, Limited Company costs £16.50 a month plus VAT with 50 percent off for 6 months, then £33 per month plus VAT thereafter. The package allows you to file for self-assessment and covers dividend vouchers along with corporation tax forecasting. Next, the Annual option is £165 per month, plus VAT with 50 percent off for the first 12 months. It includes profit share calculation. There are similar variations for Partnerships/LLPs, Sole Traders and Landlords too.

If you enter the site on its global setting Freeagent also has a Universal package, which comes in at $13.50 US with 50 percent off per month for 6 months and then $27 per month thereafter. It comes with sales tax reporting and multi-currency invoicing.

FreeAgent: Features

While the choice of plan is simple, we like that the plan is a good one, with a full feature set, and is not limited in any way. For example, there is no limit to the number of users, the number of clients, or the number of projects- making this an even better deal for a larger small business. There is also unlimited support with UK based agents.

We also appreciate the lack of set-up fees, and there is no contract or subscription required. FreeAgent is so confident in their service that it is even easy to leave by downloading the business’ data if it does not work out for any reason. Then again, if you decide to leave, make sure to grab your data as otherwise once the subscription is over you lose total access to all historic data. Another plus are the mobile apps, for both the iOS and Android platforms, making FreeAgent available while mobile, for use on a smartphone, or for those that prefer working on a tablet interface.

We found that setting up the account is painless, with questions along the way to customize the service to your business including your time zone, date format, and local currency. This is where you also enter your local sales tax details, and provide a link to your bank account. By connecting FreeAgent to the bank account gives a live view of the business’ cash flow as it can automatically import transactions on a daily basis through its ‘Bank Feeds’ feature.

A labor intensive part of running any business is invoicing, from creating them, to sending them, and finally tracking them to payment, which can too often require sending multiple invoices. FreeAgent really excels on this core task, as through a series of dialogue boxes the invoice is created, and there is opportunity to attach the invoice to a project, provide payment terms, and customize reference numbers. Then the line items and unbilled expenses are entered. There is also a neat feature that can easily transform a previously created estimate into an invoice for efficient workflow.

Further supporting invoicing, there is an option to set up recurring invoices, that are sent automatically. In addition, FreeAgent can track each invoice until payment, and automated reminders can be created to prod customers that still owe money for a truly ‘hands free’ process.

Another drudgery of running a business is expense tracking, and FreeAgent comes through here as well. Receipts for business expenses can be added by simply snapping a pic with a smartphone, and then upload it to FreeAgent. These can then be easily organized into custom categories, for a full accounting at tax filing time.

FreeAgent: Final verdict

FreeAgent is a strong entry into the online bookkeeping market. It's up against the likes of FreshBooks, QuickBooks, Xero, Sage Business Cloud Accounting, Kashoo, Zoho Books and Kashflow. You can decide if the ‘one size fits all’ offering is a good fit for your business, but we like the unlimited aspect that will scale as your business grows.

The feature set is strong, and can certainly support common business tasks, like invoicing, creating estimates, and receipts. We lament that there is only a single tier offered, as while it is an excellent deal for a small business with several employees, the monthly cost can be more expensive for a sole proprietorship with more modest needs.

Still, for a small business that has outgrown a simple spreadsheet for their accounting needs, FreeAgent is a recommended choice.

- We've also highlighted the best tax software

Jonas P. DeMuro is a freelance reviewer covering wireless networking hardware.