TechRadar Verdict

H&R Block is a leading tax preparation service with a range of options to suit any kind of taxpayer. Continued improvements to its feature set and useability makes it a solid bet.

Pros

- +

Get started for free

- +

Super simple to use

- +

Covers all tax bases

- +

Intuitive design

Cons

- -

Advanced versions pricey

- -

Cheaper alternatives

- -

Support options add cost

- -

Not quite as user-friendly as other options

Why you can trust TechRadar

H&R Block has a very high profile in the USA and for good reason. It provides a range of personal tax preparation services that range from the zero outlay basic edition right on through to sophisticated paid-for variants for those with advanced filing needs.

All this is backed up with physical outlets for in-person help if you need it. Considering the base level edition costs nothing it’s very impressive and has all the features and functionality you could realistically want.

As with other online tax services in this sector, the paid for options come with more advanced features as you progress up the scale. There is also a self-employed edition, which comes in as the most expensive of the H&R Block online tax filing versions. Rival options come in the shape of TurboTax, TaxAct, TaxSlayer, Jackson Hewitt Online, Credit Karma Tax and FreeTaxUSA.

- Want to try H&R Block? Check out the website here

H&R Block: Pricing

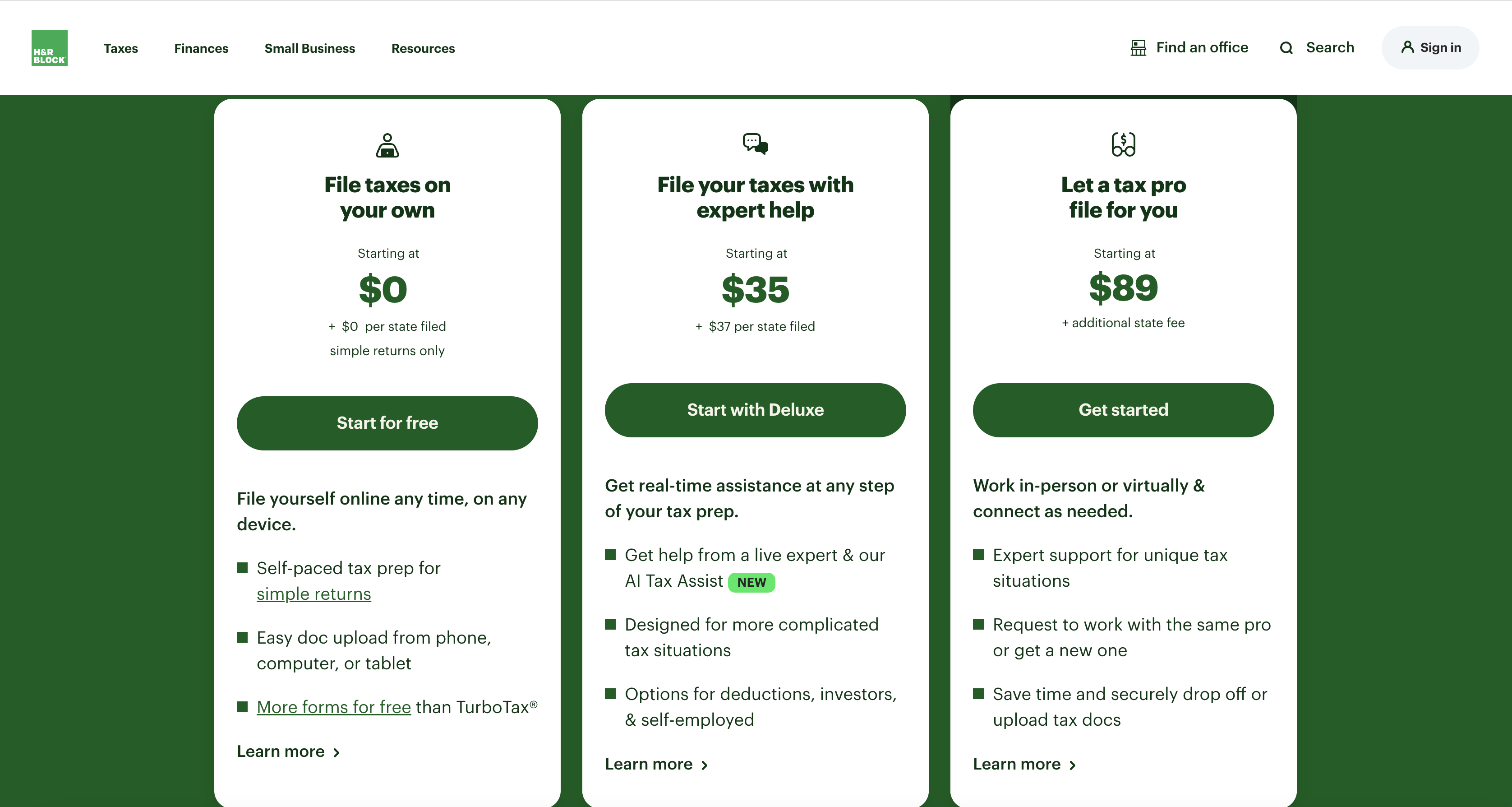

H&R Block offers a hugely flexible array of package options, which allow you to file online or work with a professional who can do a lot of the work for you. This is broken down even further, with options tailored to just how much of the work you want to do yourself.

If you do your own taxes then get started with Online, which allows you to file easily and securely from either a computer or a smartphone. Choose Free Online if you have a W-2, have kids and education costs and there’s a $0 charge per state filed too.

Deluxe Online is for maximizing credits and deductions, plus HSA contributions and currently costs $35 instead of the usual $55, plus $37 per state filed. You can initially start for free.

Premium Online is aimed at freelancers, contractors and investors and is currently $65 instead of the usual $85 plus $37 per state filed and also allows you to start for free.

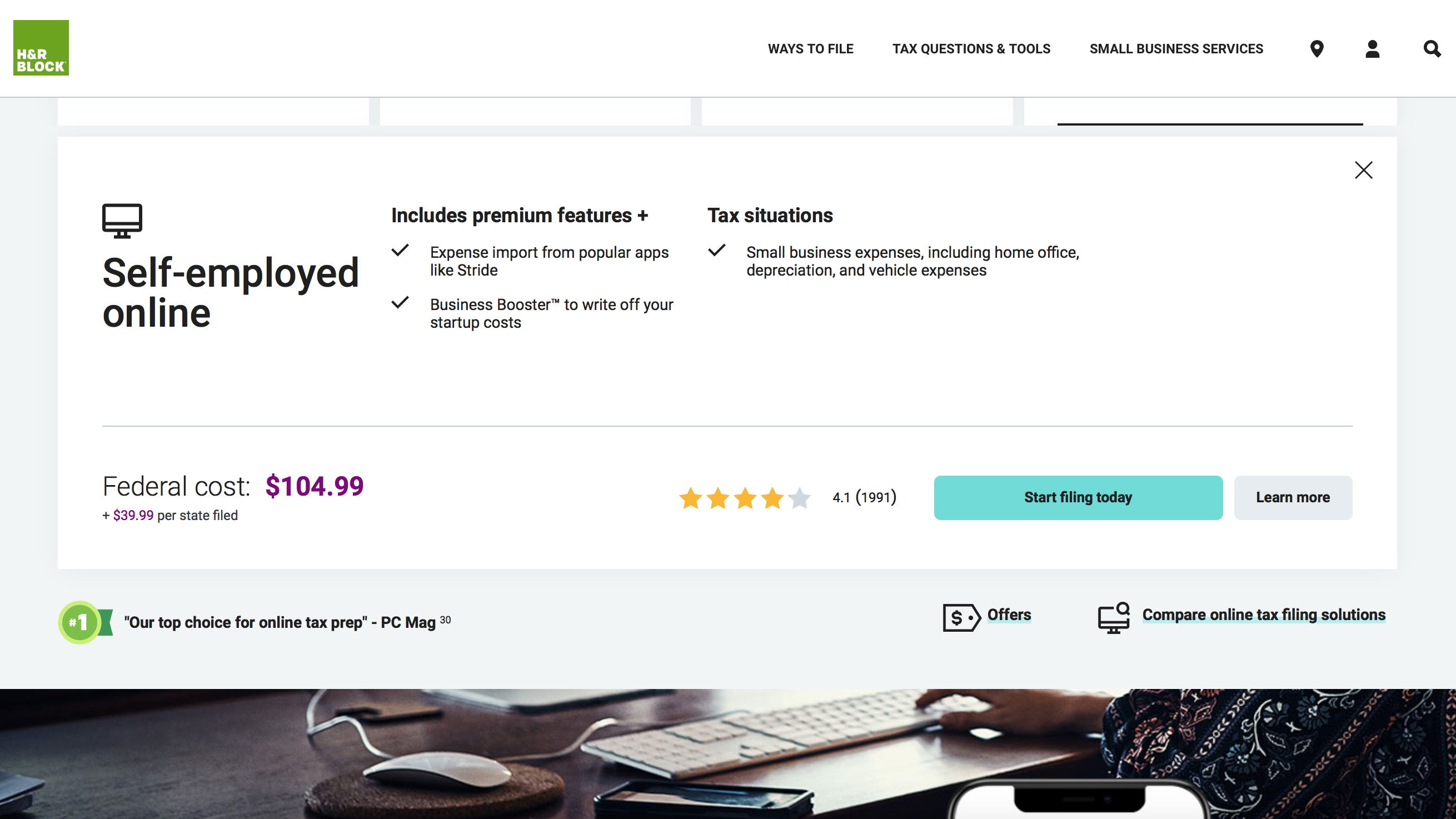

Self-employed Online, meanwhile, normally costs $115 and is currently $85, plus $37 per state filed. It's aimed at small business owners as well as the self-employed. That too allows you to start for free.

H&R Block’s Online Assist packages on the other hand, allow you to file online with on-demand help from a tax expert, enrolled agent or CPA. Basic Online Assist costs $49.99 plus $0 per state filed and suits if you have a W-2, kids and education costs.

If you'd prefer to enlist the services of a professional then H&R Block offers assistance starting from $89 plus additional state fee costs. And, of course, H&R Block offers more, including tax offices and virtual filing with a Drop-Off service that lets you take your documents to the local tax office.

Finally, H&R Block does have downloadable software options. These include its Basic Tax Software for $25, for simple tax situations, Deluxe and State Tax Software, for homeowners or investors at $49, Premium Tax Software for self-employed/1099-MISC or rental property owners for $75 along with Premium and Business Tax Software for small business owners with 10 plus itemized expenses for $89. Additional fees may also apply for these however.

H&R Block: Features

Thankfully, whatever version of H&R Block you use you’ll find that it should have more than enough features to suit your requirements. The page layouts follow a familiar theme with a methodical series of steps to work through that, eventually, get you to the last stage in the process, the filing bit.

Prior to that you’ll work through basic overview screens and move on to Federal and State sections where you’ll be able to enter more personal information as well as details on your income, deductions, credits and everything else needed to produce a complete picture of your current position.

Of course, the bonus if you’ve used the service before is that much of the information gets held in the system, and you should get access to that one you’ve logged in using your username and password.

H&R Block: Performance

Being an online service means that there’s not much to go wrong in terms of performance, just as long as your internet connection remains up that is. The wizard-style arrangement of the site design means that there’s very little you need to worry about, especially when it comes to complex IRS topics that might make your progress grind to a halt.

This is where the performance of H&R Block really impresses, as it has been honed to cover changes in legislation. This is particularly useful if you’ve used the service before and need to make sure the current year doesn't pull through the wrong information from previous years.

H&R Block: Ease of use

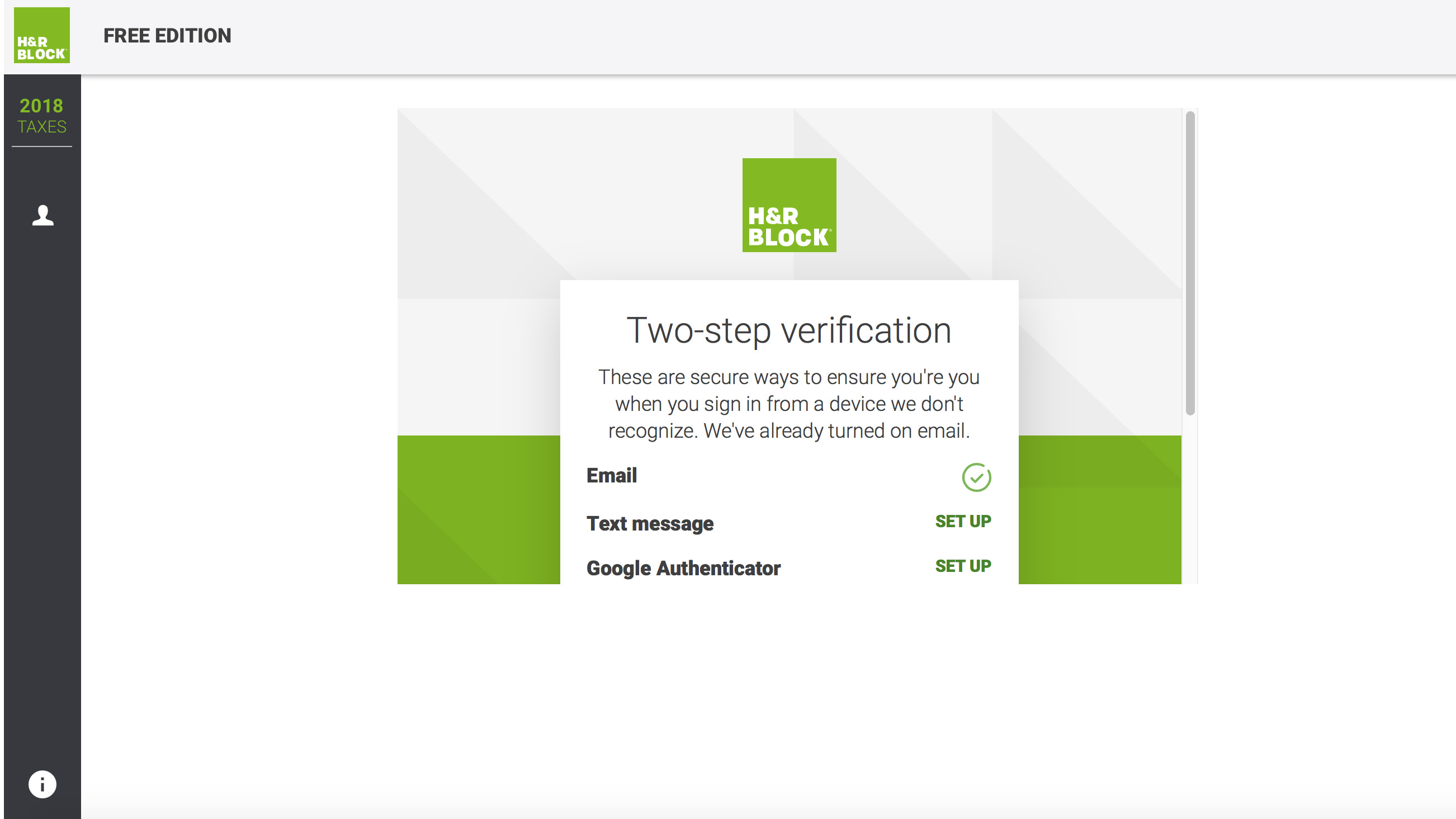

H&R Block’s online filing system is hardly intimidating as it follows a theme similar to others in the marketplace. After registering and doing all the foundation housekeeping you then progress through the various screens that help build up a picture of your finances.

Overall, the fit and finish of the interface is really pretty good, with not much in the way of areas that can trip you up. The experience is made all the better thanks to practical interface tweaks including the ability to import the details from your W-2, via either a PDF or a digital image of it from your phone, all of which is done securely so your prized personal information isn't compromised.

H&R Block: Support

H&R Block has also been well thought out when it comes to the amount of online help you can get. While some of this assistance becomes available as you progress through the series of screens, there are other areas that contain more advanced information that gets pulled in from a searchable knowledge base.

Thankfully the H&R Block user experience folks have been mindful to help you stay on track while you delve into these knowledge base articles, so it’s easy to emerge from the other side in the same place. Paid-for editions also come with help from live assistants, while the 24/7 chat support adds another level of reassurance for people who’ve got a little bogged down by the process.

Having the ability to share your screen with a live expert can be valuable and saves time, so if you’re in need of a helping hand then it’s worth the additional fees - $39.99 for Free and Deluxe users, or $49.99 for the Premium and Self-Employed editions.

H&R Block: Final verdict

There’s a version of H&R Block tax software for everyone and, no matter which one you choose, all are very well put together. The user experience, even if you’re working with the free online model, is largely stress free too.

It's also good to know that there are plenty of help options available should you need it, even though you’ll need to spend some money if you want to get access to the best there is – a real person.

However, if you’re fairly organized and have your paperwork – digital or otherwise – to hand you can also make perfectly decent use of the built-in help sections of the H&R Block website. It's a package that sits nicely alongside the competition, including the likes of TurboTax, TaxAct, TaxSlayer, Jackson Hewitt Online, Credit Karma Tax and FreeTaxUSA.

- We've also highlighted the best tax software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.