TechRadar Verdict

With reasonable fees, affordable hardware, and an intuitive interface, PayPal Zettle is a fitting POS solution for small businesses. It offers the standard features you’d expect in a POS system but not many complementary functionalities.

Pros

- +

Competitive fees

- +

Intuitive interface

Cons

- -

Limited customization and integration

Why you can trust TechRadar

PayPal is most popular for online payments processor and arguably pioneered the 21st-century online payment processing market. It began with a simple electronic payments system in the 1990s and has since expanded into many other services, including a point of sale (POS) system.

In 2012, PayPal launched a POS solution called PayPal Here. Then, in 2018, it acquired a Swedish company, iZettle, that offered a POS solution, among other services. In 2021, PayPal Here was retired and replaced by the PayPal Zettle POS. This service lets businesses accept in-person payments and keep extensive financial records.

I tested PayPal Zettle to help you decide if it’s an ideal solution for your business. My review concentrated on its core features, pricing, and user-friendliness. Read on to learn what PayPal offers with its point-of-sale system.

Zettle POS: Plans and pricing

PayPal charges a standard 2.29% plus 9 cents for card-present transactions. If card details are manually keyed in, the fees rise to 3.49% plus 9 cents (POS providers charge more for manual transactions to cover increased risks). These fees are on par with most POS providers I’ve tested; 2% to 2.5% plus 5 to 15 cents is the norm.

You don’t need recurring monthly or annual fees to access PayPal’s point-of-sale software, setting it apart from competitors with significant monthly or yearly fees.

I’ve reviewed a handful of POS systems that require $50 to $200 in monthly fees to access their features; this price adds up for businesses with limited budgets, but PayPal doesn’t have this issue.

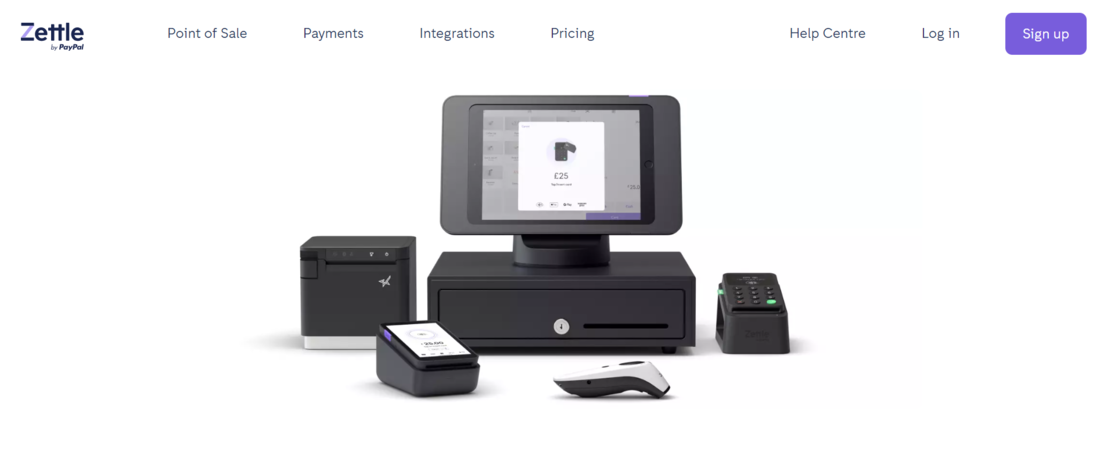

PayPal offers two hardware options: a portable card reader and an all-in-one Terminal. You can buy your first card reader at a discounted $29. Subsequent card readers will cost the standard $79. This card reader will be paired with the PayPal Zettle app to accept payments.

In contrast, you don’t need to pair the Terminal with an external smartphone. It’s a standalone device that runs the PayPal Zettle app directly. The standard Terminal costs $199, and the one with a built-in barcode reader costs $239.

PayPal’s hardware systems are reasonably priced. They cost much less than similar hardware from some POS vendors I’ve reviewed. I like that PayPal has reasonable transaction fees and no recurring fees, making it a cost-effective option.

Zettle POS: Features

PayPal provides a system for businesses to accept in-person payments. It lets your customers scan, swipe, or tap their cards to pay for goods and services. Customers can also pay you via contactless payment apps like Apple Pay and Samsung Pay. Alternatively, you can manually type in a customer’s card details, but such transactions have considerably higher fees.

At 2.29% plus 9 cents per transaction, PayPal’s fee isn’t too high compared to the competition, but it isn’t low either. It sits at the middle of the POS systems I’ve reviewed. Fees are crucial for any business choosing a POS system, and handing over 2.3% of every transaction can feel burdensome. However, most POS systems with similar features charge within this range.

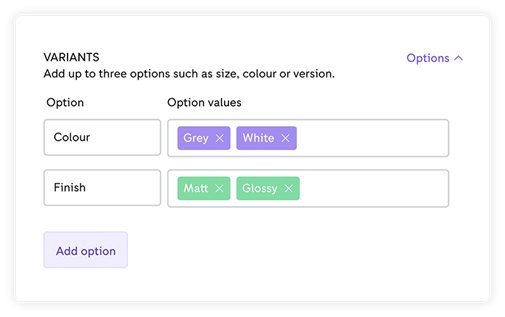

I like that PayPal offers an integrated system for accepting payments, managing inventory, and collating customer data. The PayPal Zettle app allows you to create an extensive product catalog, and product details can be quickly retrieved when a customer wants to pay.

Suppose you run a small clothing store. You can add all your store’s clothing items to your PayPal catalog, including details like their price, size, colors, etc. You can specify the quantity of each item in your inventory. When customers choose a specific item, you can retrieve it from the system, and they’ll pay the corresponding price.

Once an item is bought, the sale is immediately subtracted from your inventory. Suppose you have five units of an item and customers buy two, the inventory count becomes three. You can set PayPal to alert you when a product’s quantity falls below a specific threshold, ensuring you restock the goods to avoid disappointing customers.

PayPal offers a Terminal with a built-in barcode scanner, which simplifies operations for your store. You can create, print, and attach a unique barcode to every product in your store. When someone picks an item, you can quickly scan it to retrieve the details.

I like that PayPal offers a built-in barcode scanner, saving users the expense of buying external barcode hardware. The built-in barcode scanner worked reliably during my test; it scanned products and retrieved details without hassle.

However, you can use an external barcode scanner if that’s your preference; many businesses prefer this for redundancy. PayPal’s point-of-sale system can be integrated with external barcode apps.

The same goes for external peripherals like receipt printers and cash drawers. You can integrate PayPal Zettle’s software with external hardware accessories, a plus for businesses that want to create a custom setup.

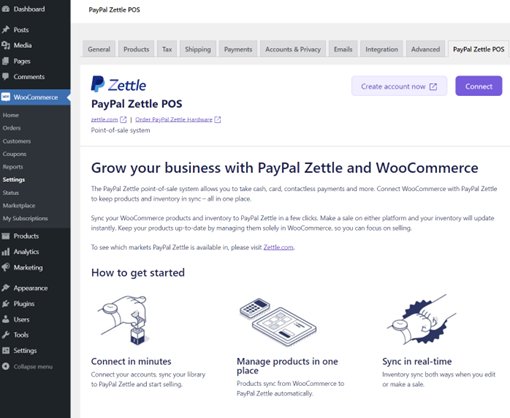

PayPal’s POS system supports direct integration with some third-party tools. For example, you can connect your system to QuickBooks, a popular accounting app. With this integration, sales on your POS system are automatically added to your accounting records.

This system integrates with popular e-commerce tools like Shopify, BigCommerce, and WooCommerce. Hence, you can sync your in-person sales catalog with your online store.

However, I didn’t like that PayPal has limited direct integrations. I found only a few dozen tools in its native integration library, unlike some POS systems that directly integrate with hundreds of tools.

If you need to integrate your PayPal POS system with an existing tool, you might need a developer to handle it, as PayPal offers direct integration only for a few dozen apps. On the bright side, PayPal provides easy API access and detailed documentation for developers to integrate external tools.

Though I didn’t experience it, a noticeable complaint arose when researching third-party opinions about PayPal Zettle. Some users complained about their accounts being paused for security purposes, with PayPal asking for additional information to verify their business. Support is often limited during this process, and users get confused about which documents to upload. Accounts under review can’t accept payments in the meantime, causing losses.

PayPal definitely doesn’t block accounts for fun. However, the company has an infamous automated review system that can ensnare legitimate users, and dealing with PayPal’s support team can be frustrating when this happens.

Zettle POS: Interface and use

PayPal Zettle has a minimalist, modern interface that I enjoyed using. It’s one of the best-designed POS systems I’ve tested, and that’s a lot of systems. It sports a white background and light colors to highlight features. The main features are neatly placed on the left side, and the dashboard is on the right.

I didn’t face any headaches setting up the point-of-sale system. If you’re using a card reader, you’ll have to download the mobile app (iOS or Android) and pair it with the reader. Pairing works smoothly via Bluetooth.

If you’re using the Terminal, the setup becomes easier because you don’t need to pair with an external device. You can follow the on-screen instructions to set up the Terminal.

Of course, you can still download the mobile app for easy monitoring. For instance, if you have multiple POS devices across different stores, you can monitor your sales on each one from your central PayPal dashboard. Your data will be arranged in a quickly digestible format, so you don’t need to stress about extracting insights.

Zettle POS: The competition

PayPal Zettle has an endless list of competitors, but I’d like to highlight Clover as the main rival. It offers robust features and is designed specifically for small businesses.

Clover charges 2.6% plus 10 cents for card-present transactions and 3.5% plus 10 cents for manually keyed-in transactions. Its transaction fees are higher than PayPal’s. Clover also charges monthly fees ranging from $15 to $90, unlike PayPal, which has no recurring fees.

However, Clover is a more versatile tool with a broader collection of third-party integrations. It can be used for different types of businesses, including restaurants.

Clover provides more complementary features than PayPal, such as employee time management. It’s more versatile than PayPal Zettle, but the tradeoff is higher fees.

Zettle POS: Final Verdict

PayPal Zettle is a decent point-of-sale solution for small businesses seeking a simple setup. It offers competitive transaction fees, a well-designed interface, and affordable hardware options.

Yet, I don’t rank PayPal Zettle as an ideal POS solution for large businesses. It doesn’t offer many advanced features and has limited third-party integration. Its fees are competitive, but it’s not the versatile solution that large retailers need.

Stefan has always been a lover of tech. He graduated with an MSc in geological engineering but soon discovered he had a knack for writing instead. So he decided to combine his newfound and life-long passions to become a technology writer. As a freelance content writer, Stefan can break down complex technological topics, making them easily digestible for the lay audience.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.