TechRadar Verdict

SurePayroll is a straightforward payroll software that can work well for a wide variety of small businesses. While it lacks some modern automation or visualization features, it’s affordable, flexible, and easy to use.

Pros

- +

Very flexible setup

- +

Relatively inexpensive

Cons

- -

Limited reporting customization

- -

Few automation options

Why you can trust TechRadar

If you’re looking for the best payroll software for your small business, SurePayroll is worth a closer look. This payroll platform is fairly inexpensive and makes it surprisingly easy to deal with complex pay arrangements. While SurePayroll doesn't offer a huge amount of flexibility when it comes to analytics, all of the data you need to run your business is available at no extra charge.

- Our guide to the best payroll software

Plans and pricing

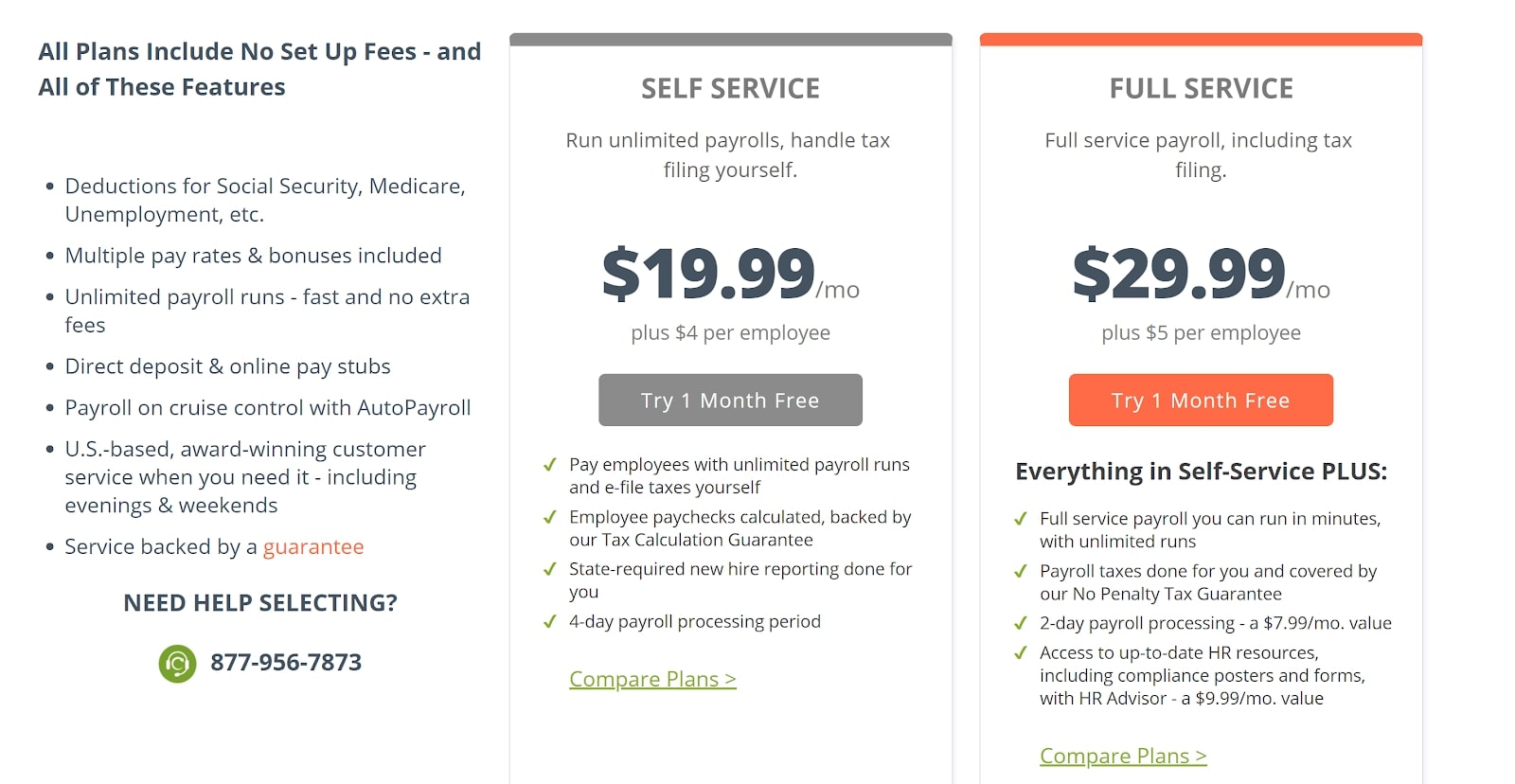

SurePayroll offers two relatively affordable pricing tiers. The Self Service plan costs $19.99 per month plus $4 per employee. It offers everything that most small businesses need, including unlimited payroll runs and direct deposit to employees. The main feature missing is that SurePayroll won’t e-file your payroll taxes for you each quarter

For automatic filing, you can upgrade to the Full Service plan for $29.99 per month plus $5 per employee. The Full Service plan also speeds up payroll processing from four days to two days and gives you access to free workplace compliance posters to display at your business. Regardless of whether you have one employee or dozens, you’re free to choose between the Self Service and Full Service Plans.

SurePayroll also offers a few add-ons. For example, you can integrate your favorite accounting software for $4.99 per payroll processed or integrate a time clock for $4.99 plus $3 per employee per month.

SurePayroll: Features

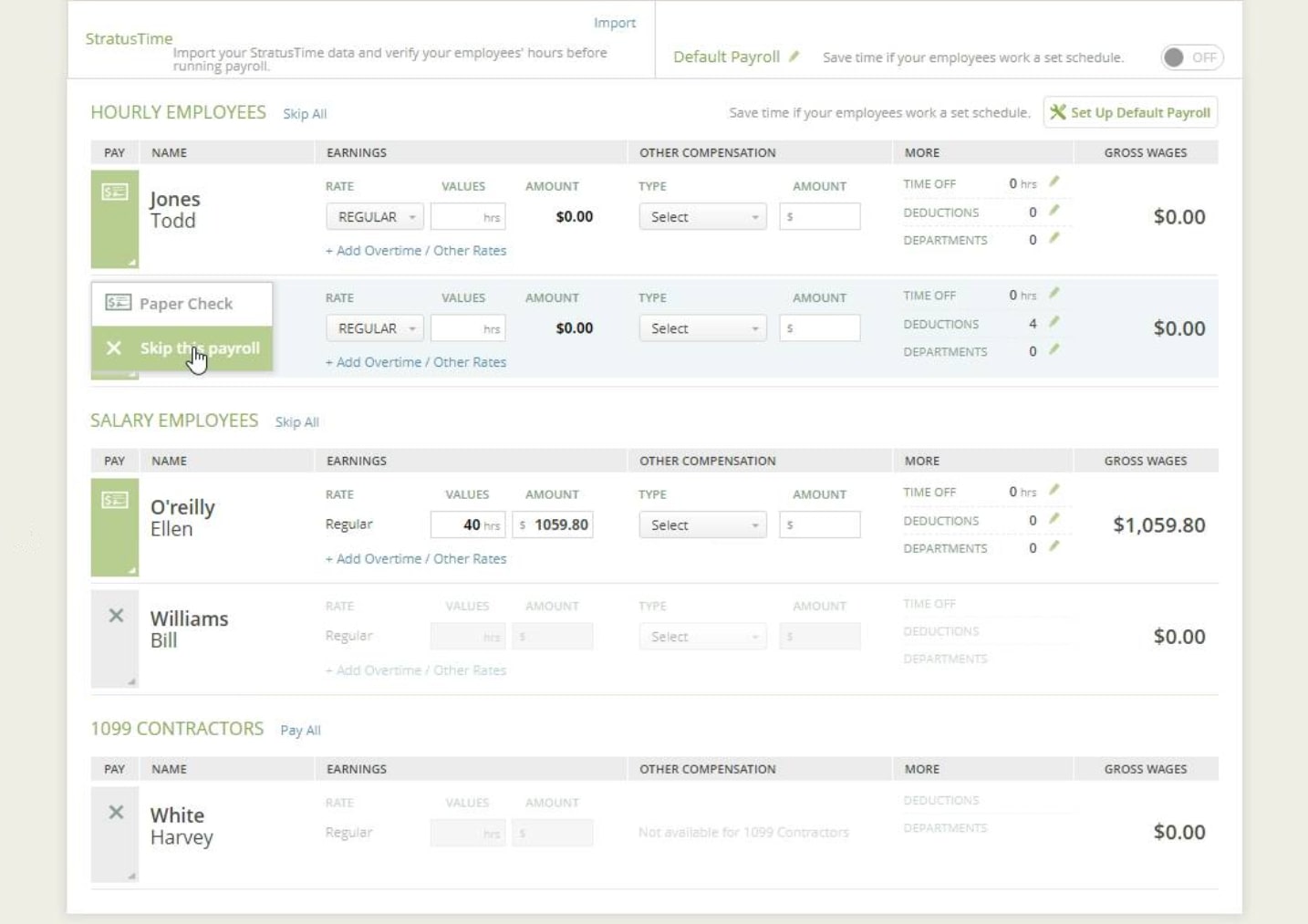

SurePayroll isn’t the flashiest payroll software we’ve seen, but it excels at the details. This platform supports a wide variety of employee types, including hourly, salaried, and contract employees. You can create multiple pay rates for every employee, making it easy to coordinate overtime payments or to offer different hourly rates for different projects.

We also liked that SurePayroll enables you to process other types of compensation within your payroll. For example, if you need to reimburse employees for travel or want to provide credits for something like a gym membership, you can easily set that up through the platform. Every type of compensation gets its own tax rules, too, which makes dealing with quarterly payroll taxes much simpler.

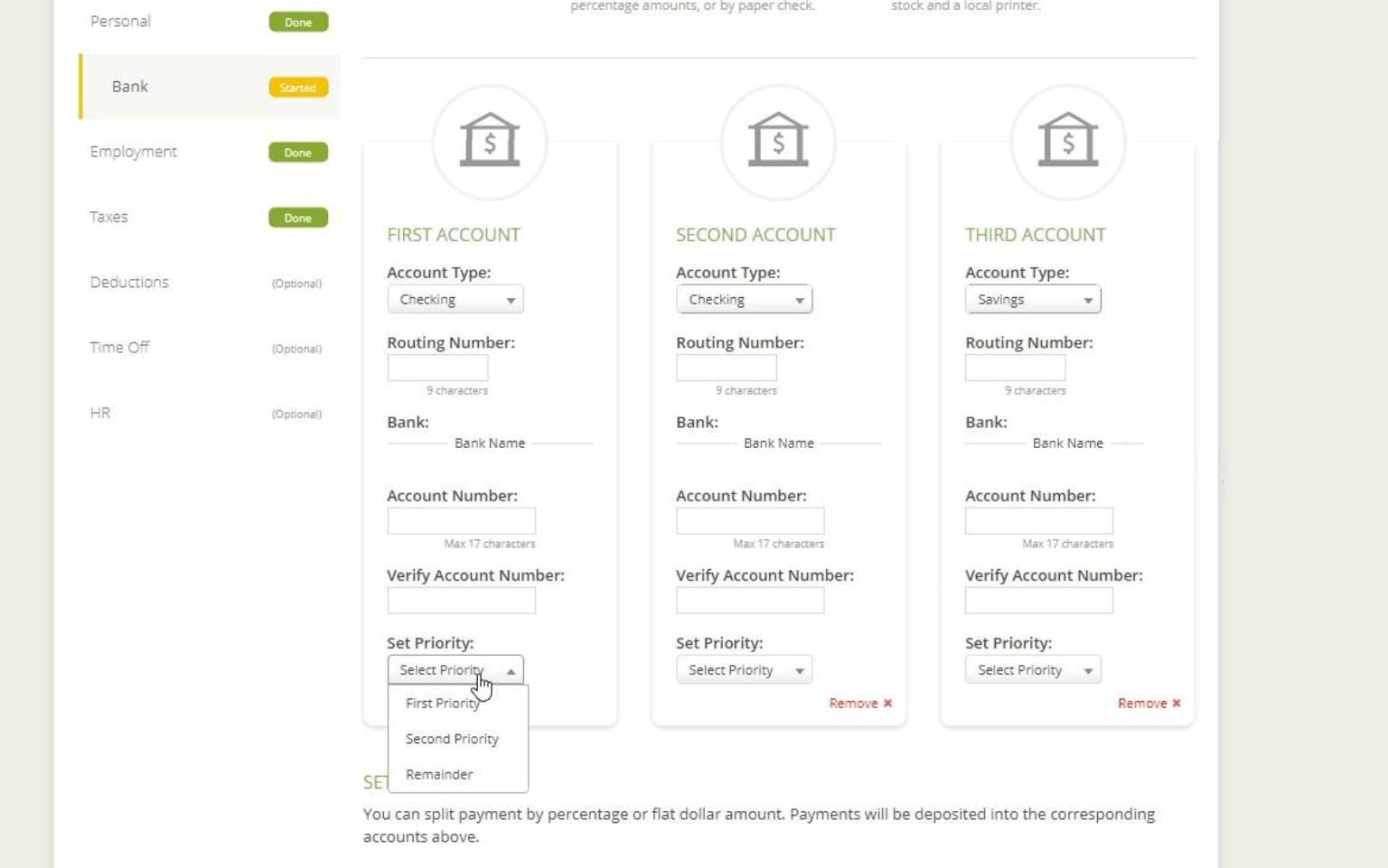

Another nice feature within SurePayroll is that you can create up to three bank accounts for each employee and divide payments among them however you want. While most employees might not need this degree of flexibility, it’s emblematic of the approach that SurePayroll takes. Rather than try to shoehorn you into what the company thinks payroll should look like, it gives you the tools you need to run payroll the way you want.

Interface and in-use

Setting up payroll with SurePayroll is fast and seamless. The company breaks down the onboarding process into five short steps, and you have the option to put off adding employees if you’re short on time when you first create an account. If you’ve already paid employees from your business, a SurePayroll agent will get in touch automatically to ensure the setup process goes smoothly.

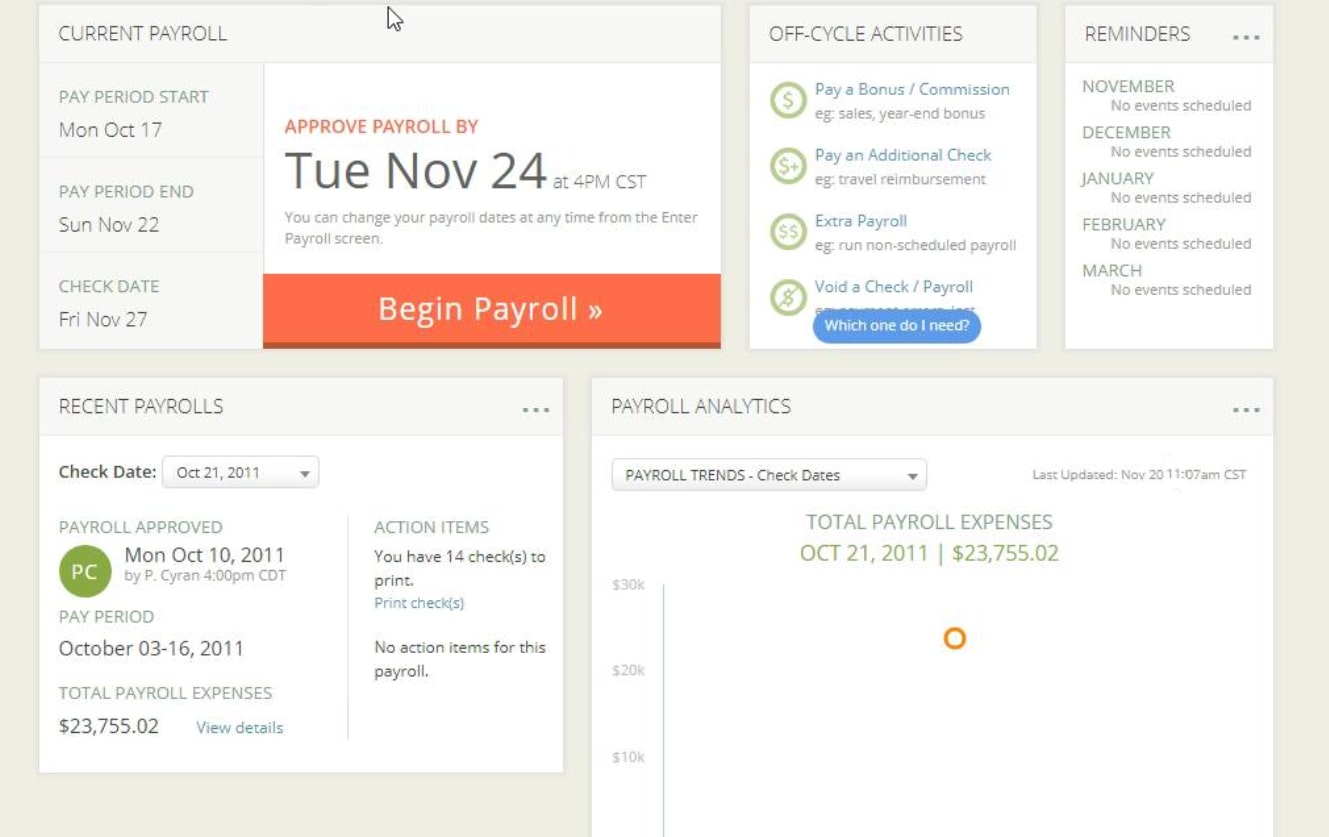

The SurePayroll dashboard looks a little outdated compared to the onboarding screen, but it’s very easy to navigate. One thing we liked is that the dashboard clearly displays your current payroll period and the day by which you need to approve payroll for the next pay date to proceed on time. You can also set SurePayroll to send reminder emails one or two days before the next approval date.

The only thing that might turn some business owners off about SurePayroll’s interface is that the platform’s reporting isn’t all that visually appealing. The software relies heavily on tabular reporting to review your payroll history. All the tax documents you would need to send to an accountant are available in your dashboard to be downloaded, but you won’t find much explanation if you’re trying to manage your end-of-year taxes on your own.

SurePayroll also offers a mobile app with portals for both business owners and employees. Importantly, it’s easy to review and approve payroll from the app.

Support

SurePayroll offers phone and live chat support from 8 am to 9 pm Eastern from Monday to Friday, and from 10 am to 2 pm on Saturdays. We found the company’s support team to be extremely responsive, especially during the onboarding process.

The competition

There are relatively few payroll software platforms as affordable as SurePayroll. Patriot Software has a Basic plan that costs $10 plus $4 per employee per month. It’s comparable to SurePayroll’s Self Service plan in that neither offers automatic payroll tax filing.

If you’re looking for a full-service payroll service, Gusto’s Core plan is similar to SurePayroll’s Full Service plan. However, it costs $39 plus $6 per employee per month, making it significantly more expensive. However, Gusto can be a good option if you want customizable reports or payroll automation features, which SurePayroll doesn’t offer.

Final verdict

SurePayroll is an inexpensive and easy-to-use payroll software for small businesses. The platform is very flexible, giving you the control you need to manage multiple employee types and multiple compensation plans. Although SurePayroll isn’t as visually engaging or automated as some of its competitors, we think it’s a good choice for businesses that list ease of use and quick setup as priorities.

Further reading

- Read our guide to the best payroll software

Michael Graw is a freelance journalist and photographer based in Bellingham, Washington. His interests span a wide range from business technology to finance to creative media, with a focus on new technology and emerging trends. Michael's work has been published in TechRadar, Tom's Guide, Business Insider, Fast Company, Salon, and Harvard Business Review.