TechRadar Verdict

The Untied app is great for staying on top of your accounting chores and then being able to file a tax return to HMRC all from within one mobile solution.

Pros

- +

Good value

- +

Works on the fly

- +

You can submit tax returns to HMRC

Cons

- -

Mobile only solution

Why you can trust TechRadar

Untied is a personal tax app that’s been designed to help the self-employed organize their financial affairs and be well prepared come tax-filing time. With simplicity at its core, Untied aims to connect you to your bank accounts, allow you to quickly and efficiently tag income and expenses and, ultimately, let you submit your tax return correctly and on time. Crucial given the situation with coronavirus.

The service is app-based, so it’s got all of the tools for sorting taxes and other financial tasks on the go, rather than needing to sit at a desktop machine or laptop. Convenience and ease of use appear to be the main appeal with the ‘UK’s personal tax app’, as Untied describes itself.

Other competitor options worthy of investigation include FreshBooks, QuickBooks, Sage Business Cloud Accounting, Kashoo, Zoho Books, ABC Self Assessment, Xero and Kashflow to name but a few.

- Want to try Untied? Check out the website here

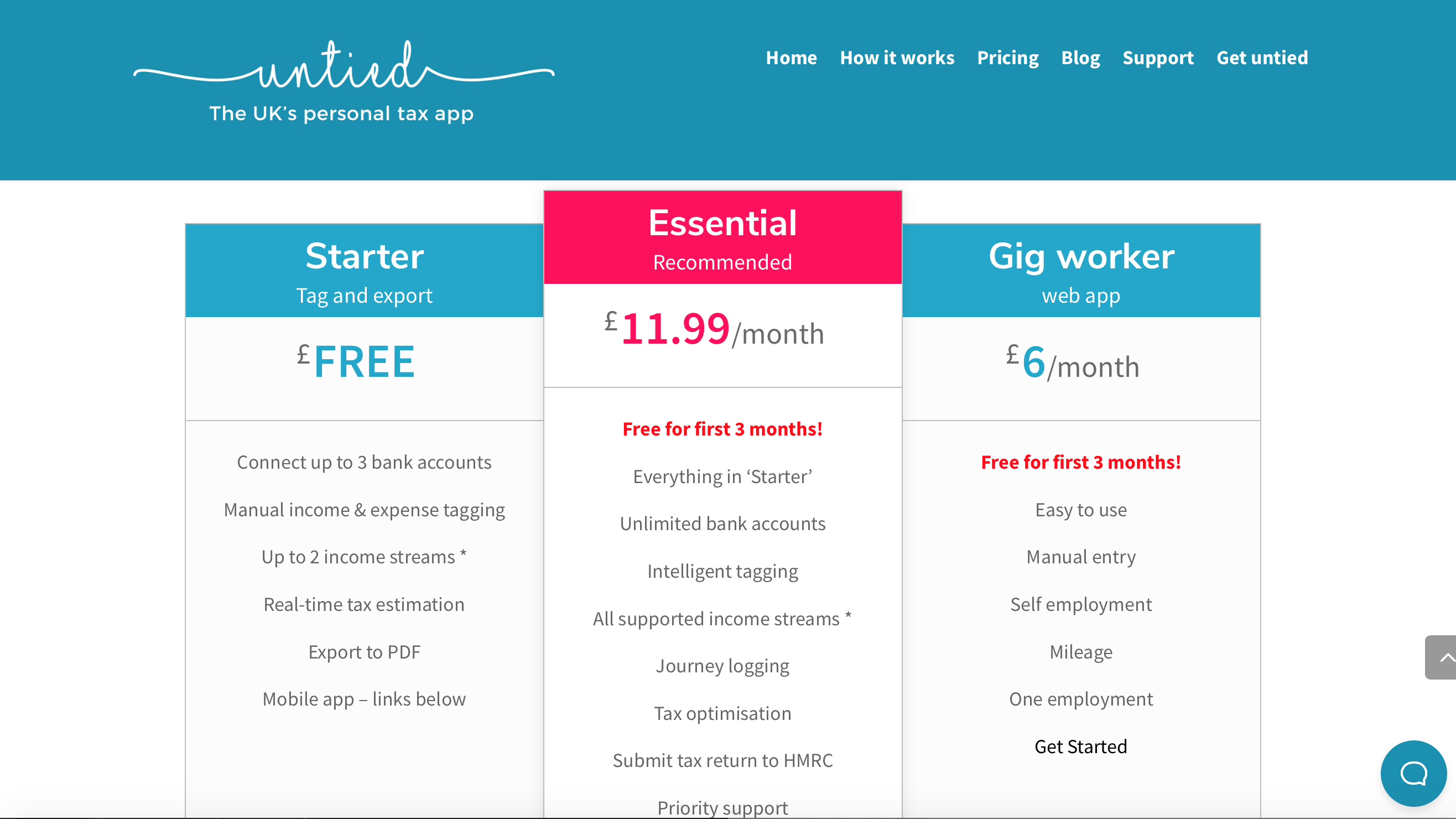

Pricing

The Untied personal tax app is focused on UK users, so pricing is available in pounds only. There are three different package options on offer, with a free Starter edition that comes with a decent spread of functions. It allows you to connect up to three bank accounts, tag income and expenses and also work with up to two income streams.

These can include self-employment income up to £85k, property income up to £85k, PAYE salary income, dividend income and bank interest too. The real-time tax estimation works on this free version, while it's also possible to export data as a PDF.

Next up, the Essential package is £11.99 per month (free for the first 3), which comes with everything in the Starter bundle. It adds the ability to connect unlimited bank accounts, intelligent tagging, all supported income streams, journey logging, tax optimisation and the freedom to submit your tax return directly to HMRC. There’s priority support too.

A Gig worker edition of Untied is the other option, which is £6 per month (free for the first 3 months) and is aimed at the more occasional freelancer who might not need the more advanced tools and features found in the Essential edition.

Features

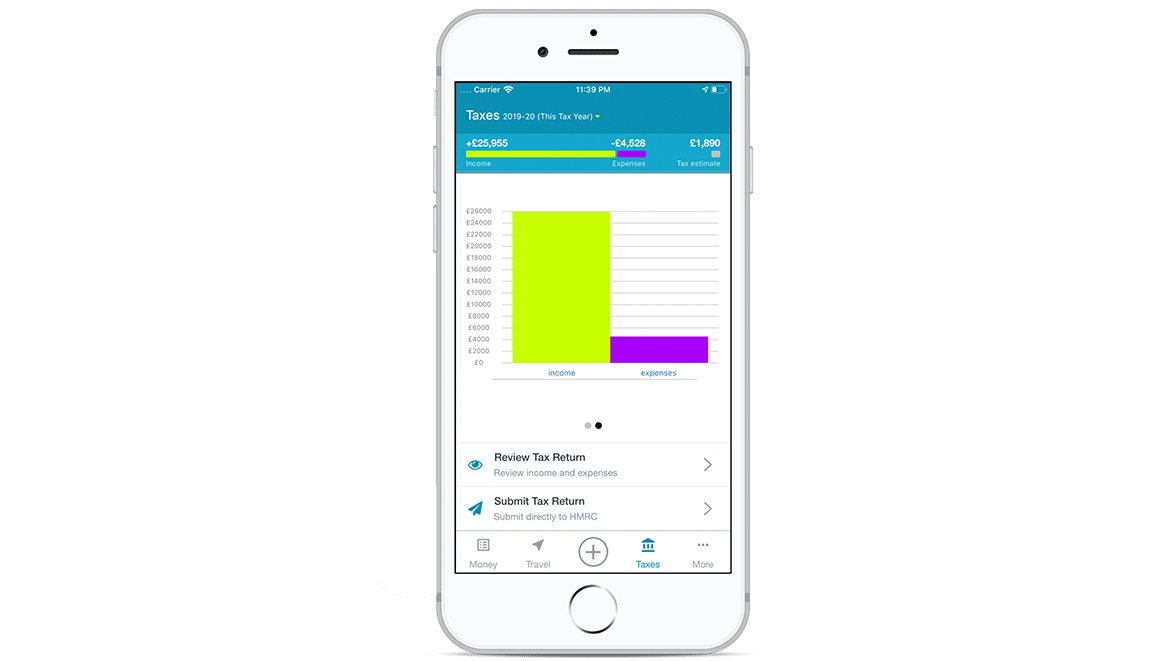

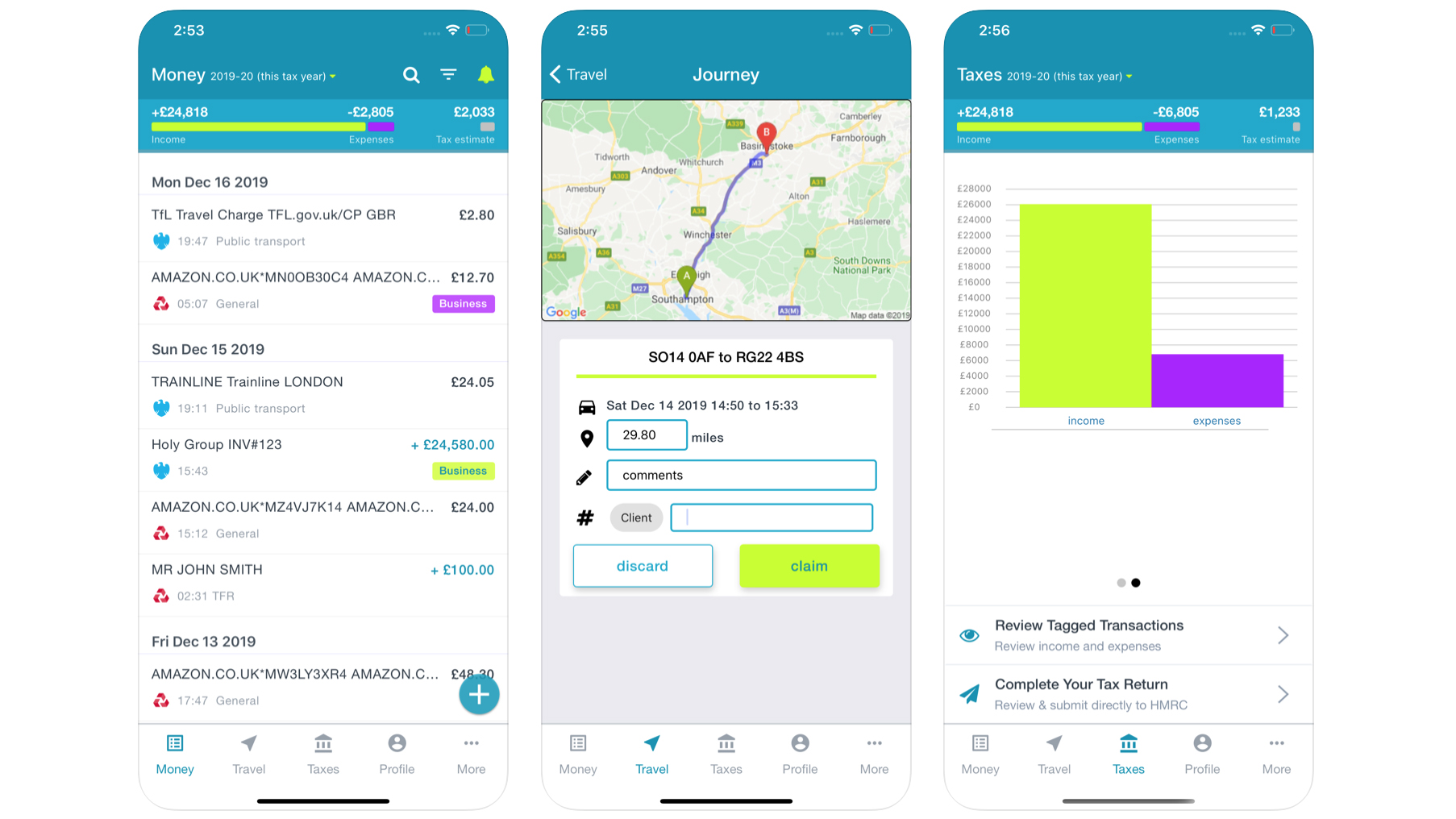

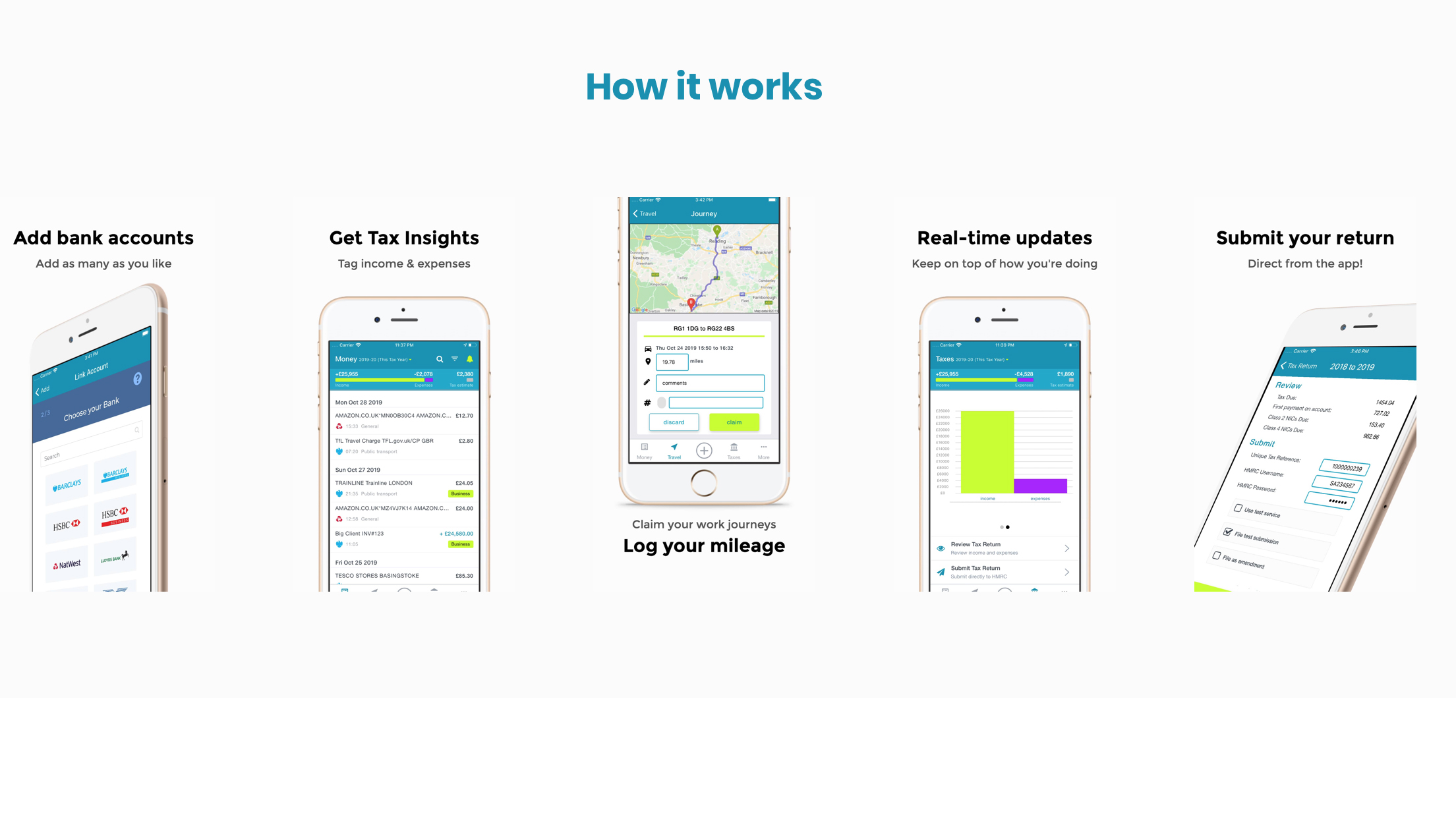

With simplicity at its root, Untied comes with plenty of features aimed at reducing the time you take to stay on top of your finances. It’s possible to add as many bank accounts as you like, tag income and expenses as well as log mileages for work-related travel. The app works dynamically, so you can get real-time updates on how your finances are faring. At the end of the tax year you can subsequently use the data that’s been accumulated by Untied to file a return to HMRC.

Ease of use

It’s all about the app when it comes to using Untied and the designers have done a great job with it. The interface is simple to navigate, everything is logically laid out and there don't appear to be any major sticking points. You can get the app for iOS and Android.

The full app offers the ability to link to bank accounts, logs mileage dynamically and comes with several other features that require very little in the way of input to work. If you’ve got little inclination to explore those features, or a light workload, you can opt for the Untied package, which is aimed at gig-type freelancers. However, what is hugely beneficial is that you can submit a tax return to HMRC from either one.

Support

If you’ve signed up for the Essential package then Untied comes with priority support. Outside of that there’s a very good and easily searchable knowledge base that will take you through the many features found inside Untied. There’s also a contact form that lets you to send them an email and include any attachments if necessary.

Untied also features a chat-bot style helper, which can be used to find answers to queries, or you can ask your own question if it isn’t covered by the database. Meanwhile, the Untied blog proves useful for getting a little more background on the app and how it works for users.

Final verdict

Untied is a fine proposition for anyone in the UK who carries out freelance work for a living and needs to submit a tax return to HMRC at the end of the financial year. The way the app works dynamically on your mobile device ensures that you always get an up to date picture of your incomings and expenses, while the resulting calculation prior to filing time cuts down on bookkeeping faff.

The app has been well designed and the price point is affordable. That said; the free option is one to think about if you’ve got very straightforward or basic accounting needs. For a little bit of outlay though you’re better off going for the paid-for edition and enjoying all of those beneficial features, including the ability to link and sync with your bank accounts.

- We've also highlighted the best tax software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.