TechRadar Verdict

Wealthify offers a simple to use investment platform with a good range of features for the novice investor. Experienced investors may find it better to look elsewhere.

Pros

- +

Completely automated investments

- +

Robust customer support

- +

Open your account for just £1

- +

Owned by Aviva

Cons

- -

Limited control

Why you can trust TechRadar

Wealthify is a platform designed to provide you with a simple and easy way of investing your money through a digital management option. The firm is based in Cardiff, UK, and was founded in 2016. The investment platform works through a website and an app, but also has human advisers available on the phone.

In tune with a host of other robo-advisors such as Acorns and Stash, the platform automates your investments based on the risk-taking abilities of its customers. Wealthify was acquired in 2017 by Aviva, which is one of the largest insurance companies in the UK, which may give confidence to users, as well as signal a wider acceptance of robo-investing by traditional business.

What does Wealthify offer?

Like most of the other micro-investment options currently available, Wealthify caters to the wide range of investors who are looking for an investment opportunity with minimal input. In a traditional market setup, this is something you would not be able to do, and that is where the companies such as Wealthify step in.

To begin with, you need to choose one among their four different investment plans. These plans are based on the risk factors involved and the amount of money you would be willing to invest in. Wealthify will then invest this money into stocks, bonds, ETFs and mutual funds, in accordance with your risk tolerance and automated investment algorithm.

Accounts

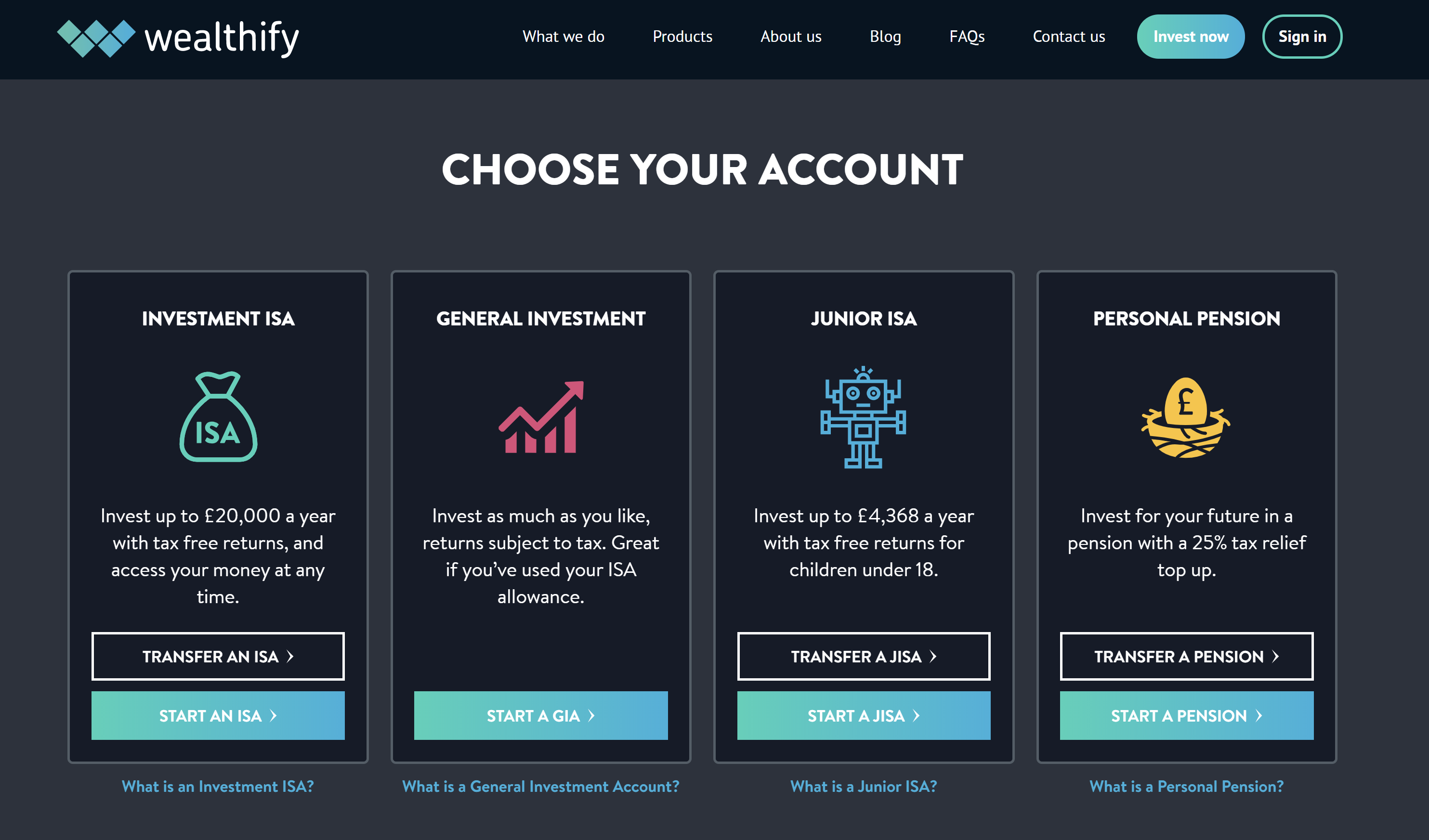

Investment options you can choose include:

- Investment ISA – ISA refers to an individual savings account. You can choose between Cash ISA, Investment ISA, Innovative Finance ISA, and Lifetime ISA. You would be able to invest or save up to £20,000 tax-efficiently each year

- General Investment – This will be the best option if you have already exhausted your ISA quota. Wealthify lets you make a choice between an original plan or an ethical plan

- Junior ISA – If you want to invest enough for your child's future, the Junior ISA is an excellent choice. It can be an effective option to save up to save up to £4,368 tax-free for the future of your child

- Personal Pension – This, obviously, is a plan for your long term goals. You can either supplement your regular pension or transfer your existing funds for a better yield.

Features

Wealthify manages portfolios with a mix and match of both automated and manual systems. It uses a computer-managed algorithm to arrive at the right type of investments based on customer preferences in terms of risk-taking. It has been established that these automated methods tend to be cost-effective and thus would be helpful in letting the clients invest with lower fees.

The best part is in addition to the automated investment, Wealthify experts also make adjustments to your portfolios whenever they feel it is adequate. That would perhaps be one of the strongest factors that Wealthify offers in terms of an effective and efficient portfolio management and oversight.

Wealthify recently changed its fee structure in December 2019 and has switched to a flat fee of 0.6%. That would perhaps make Wealthify one of the cheapest options when compared to the other robo-advisors. Especially when your investment threshold stays at £20,000 or lower each year.

They also have a ‘refer a friend’ initiative through which you can gain £50 per friend that they refer to.

The charges levied are competitive for smaller investors and thus can be quite useful for those looking to have a look at diversifying their investments and learning the tricks of the trade.

Website and apps

The website is user-friendly and easy to use. It provides you with a complete usability with the easy to understand menus and tabs. The mobile usability of the website is an added asset. However, you would not find any educational material on its website or mobile app. This would be something lacking when compared to the platforms like Acorns or Stash.

The mobile app also is quite user-friendly and carries all the aspects from the website. That would make it one of the absolute plus points when it comes to an understanding the concept and checking out your portfolios on the move a lot easier.

Support

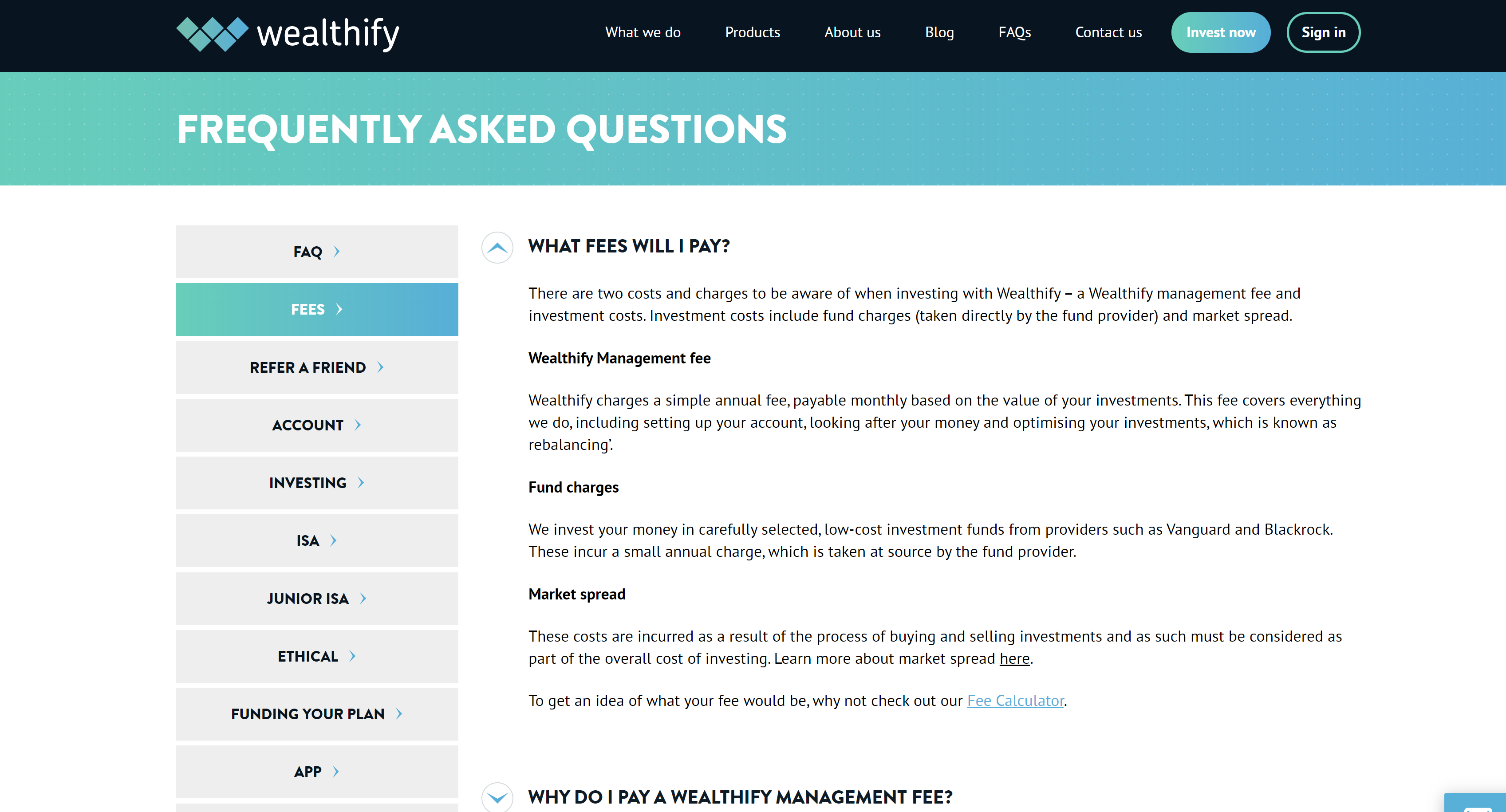

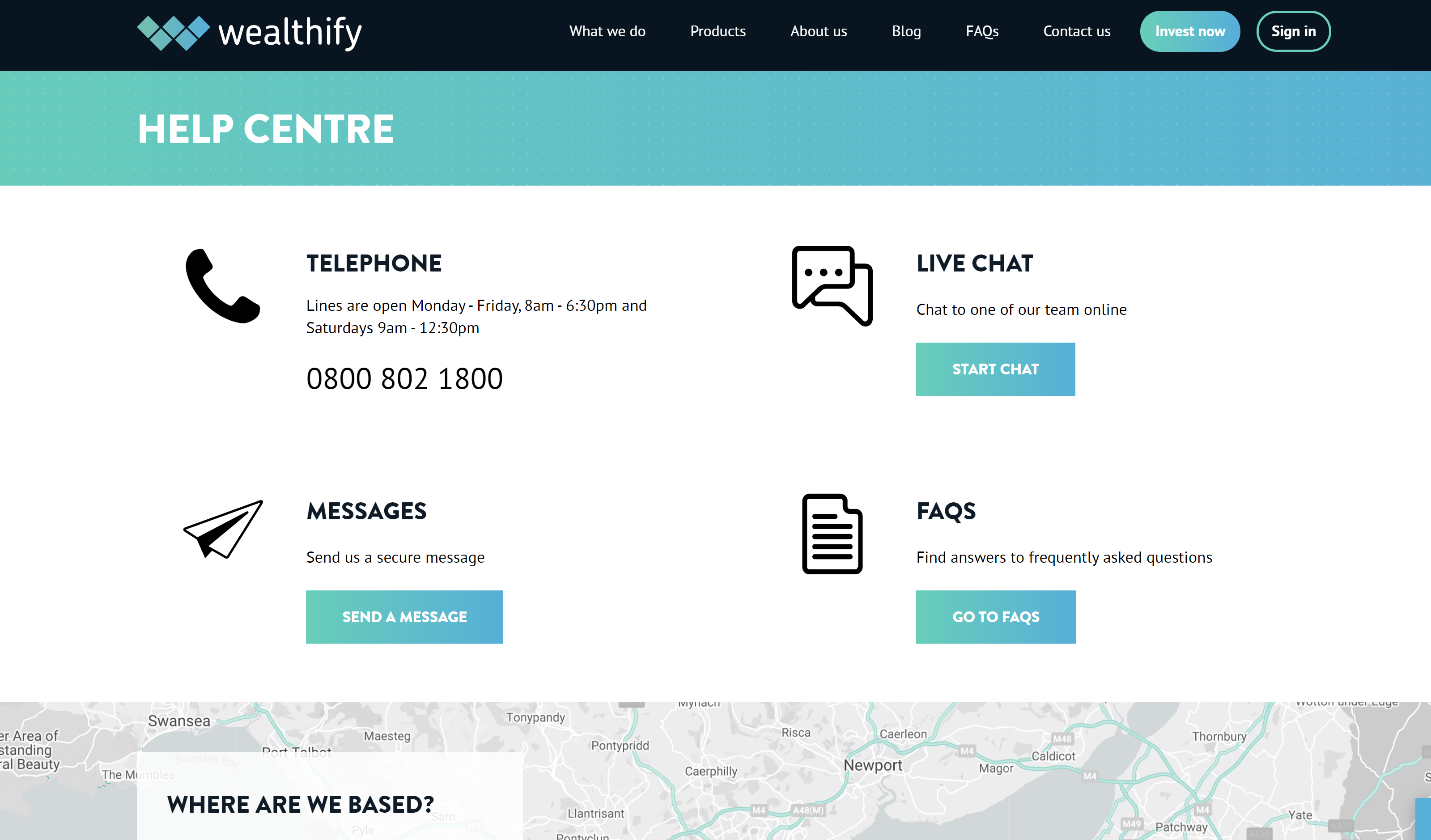

Wealthify provides you access to the normal website support for general queries or technical support. You can also access an extensive FAQ section that should be capable of answering most questions.

Other support options available for the customers include phone, email form, messaging, and a live chat. The phone queries are answered by the UK based staff and will be available Monday to Friday between 9.00 am to 6.30 pm. The phone support is available on weekends as well on Saturday and Sunday between 9.00 am to 12.30 pm.

Do note, however, that the support staff does not provide any sort of financial advice, which is done only through the automated robo-adviser. There are no human advisers available.

Final verdict

if you are looking for a hassle-free passive investment option, Wealthify could be a good platform to look at. This is especially for those people who don't understand investing and would rather avoid the hassle of picking specific shares and funds, so long as they could manage the risk.

This means that while Wealthify could be ideal for novice investors, more experienced ones may find it too limiting, especially in terms of the lack of controls.

The fact that the platform is owned by Aviva should certainly be a confidence booster to those potential users looking for a platform to invest through, but are unsure of which providers to trust.

- Best forex trading platform: trade and invest on your Android or iPhone.

Jitendra has been working in the Internet Industry for the last 7 years now and has written about a wide range of topics including gadgets, smartphones, reviews, games, software, apps, deep tech, AI, and consumer electronics.