Apple HomePod holds just 4% of the smart speaker market, according to analysts

But that figure could more than double within four years

By the end of 2018, people who love AI assistants and hate tapping out questions on their phones will have bought 100 million smart speakers. And that number could soar above 300 million within the next four years.

So far, not many of those 100 million have been Apple HomePods. In a Monday report, analyst firm Canalys stated that Apple will control only 4% of the smart speaker market by the end of this year – so, approximately 4 million in sales.

By comparison, Amazon will control “over 50%” of total sales with its Amazon Echo line, while Google and its Google Home speakers will constitute 30%.

Canalys’ analysis confirms earlier reports that HomePod trails far behind Amazon Echo sales in 2018. Slow sales reportedly led Apple to reduce production of HomePod speakers.

One could argue that 4% market control after half a year of sales isn’t that substandard, considering Amazon has sold multiple smart speakers for years – but Apple clearly has loftier ambitions.

According to the report, Apple will improve its sales somewhat by 2022, raising its total market control to 10%. Perhaps the rumored Apple HomePod Mini launch could help the company improve its totals.

Simultaneously, Amazon’s current smart speaker market dominance could start to dwindle within that time.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.

In the short term, the upcoming Amazon Prime Day sales and newly announced Alexa for Hospitality (hotel room smart speakers) could help drive up Amazon’s market dominance, the report says.

Yet, in the long term, Canalys predicts that “other” smart speaker manufacturers will claim 21% of the market by 2022, and that Amazon will lose much of its market share to those companies.

Ultimately, Amazon and Google could both control 34% of the market, meaning that Google is projected to gain ground while Amazon loses it.

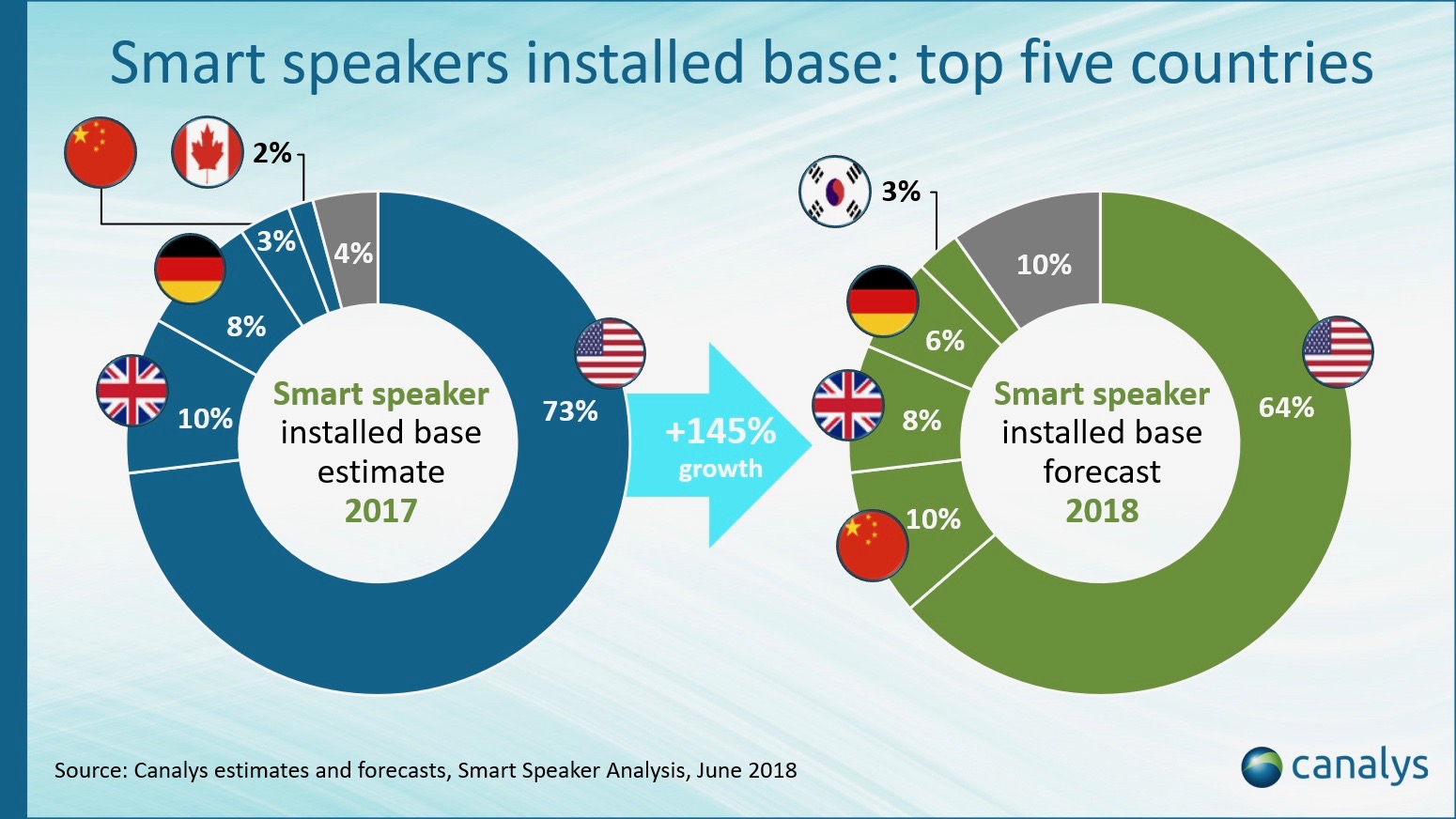

Canalys also broke down the worldwide distribution of sales by country. The United States currently leads the pack at 64%, followed by China at 10%, the United Kingdom at 8%, Germany at 6% and South Korea at 3%.

Plus, China’s market share is projected to grow exponentially over the next 10 years.

Predicting the 'other' smart speakers

Up until now, Amazon Echo vs Google Home has been the only real smart speaker war to watch closely.

But, this report suggests that other upcoming launches could really resonate with consumers.

Facebook’s smart speaker with rumored 15-inch screens may have been a contender before recent scandals delayed the launch, but now Facebook is considering a non-US speaker launch, which locks it out of the most profitable sales market.

The Samsung Bixby smart speaker, projected to launch in late 2018, could be a legitimate sales contender, since it will be able to connect its speaker with other Samsung products like its smartphones and TVs.

Spotify’s rumored smart speaker could also generate some buzz when it launches, and even Ikea plans to launch a smart speaker of its own with Sonos. But, we suspect these won’t be able to get quite as much traction as those made by other, bigger tech companies.

Via 9to5Mac

- Find the best smart speaker for your home

Michael Hicks began his freelance writing career with TechRadar in 2016, covering emerging tech like VR and self-driving cars. Nowadays, he works as a staff editor for Android Central, but still writes occasional TR reviews, how-tos and explainers on phones, tablets, smart home devices, and other tech.