Telematics: what you need to know

How digital telematics tech will make you drive more carefully

Own a car? Chances are your car is spying on you and reporting your driving style to your insurance company. It may even be keeping track of any risky maneuvers you perform, your fuel usage, and where your usual hangout place. And how, you might ask? It's all made possible through digital telematics.

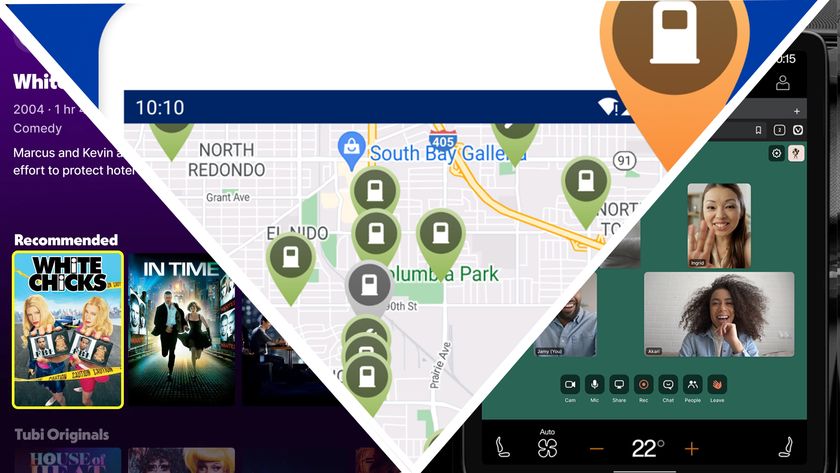

Telematics is an advanced vehicle monitoring system that combines GPS tracking and on-board diagnostics. This integration allows for the meticulous recording and mapping of a vehicle's location and speed, and cross-reference this information with the internal behavior of the car.

With the addition of communication over a 3G network, telematics becomes a powerful tool for exchanging both data and communications between a vehicle and a central management system. Formula One teams have long harnessed this technology, utilizing sensors and a trackside wireless network to precisely determine the positions of opponents on the racetrack.

At the fringes, telematics is also a term used to describe 'connected car' features in general. These features include live weather, traffic, and parking information on the dashboard, as well as apps, and voice-activated features. There is even—gulp—Facebook integration.

Who uses telematics?

All of us. Telematics can be used for monitoring complete fleets of vehicles (everything from courier companies to emergency services) and even for tracking stolen cars. Increasingly, it's found integrated into connected cars – imagine a situation where your car breaks down, and the AA is automatically alerted with data on your car's diagnostics, making assessment and repair much quicker. Moreover, insurance firms will be able to better assess insurance cases with telematics data on driving behavior and circumstances, ultimately improving the claims process.

How did it come about?

Technology is ever changing – and so is the law. The European Court of Justice has ruled that from the end of 2012 car insurance premiums must be gender neutral – Sheilas' Wheels now charge the same prices to women and men – so car insurers have to find another way of assessing risk. What better way than using accurate data on how we, as individuals, actually drive? That said, the totally open, transparent approach that telematics brings might be too much of a leap for some insurers nervous about sharing personal data.

This is 'pay as you drive', right?

Wrong. As the use of telematics is, ahem, accelerating, it's also undergoing a change from being focused on pay as you drive (PAYD) to pay how you drive (PHYD).

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

"We basically monitor and assess the driving behaviour of the vehicle user via on-board technology which enables us to provide a much more accurate rate, and a very specific understanding of risk," says Johan van der Merwe, MD of pay-as-you-drive car insurer Coverbox, which also offers free theft tracking.

"The amount of information we gather from devices installed in customers' vehicles – time and location of journeys, driver behaviour during those journeys, and so on – means that we are in a position to develop much more bespoke insurance products, personalised to specific drivers."

Telematics also means that well-behaved drivers can be rewarded with lower fees.

"We all know young drivers who are maniacs behind the wheel, but we also all know young drivers who are incredibly safe and sensible behind the wheel," says van der Merwe. "The current insurance market lumps them all together as being equally high liability. We can change that."

The more detailed the information collected, the closer the insurance industry can get to accurately apportioning blame to specific drivers involved in an accident.

Will telematics tech mean lower car insurance premiums?

Telematics insurance and car insurers have transitioned to a 'de-averaged' pricing model, where rates are solely determined by driving style and location rather than lifestyle and home address. In short, it's fairer. This not only results in reduced insurance claims for low-risk drivers but also offers valuable performance feedback, leading to fewer crashes and incidents.

Also known as the Black Box policy, this insurance strategy grants drivers premium discounts based on their driving performance, including metrics like braking and cornering. Additionally, some policies specifically reward those who maintain low mileage.

How will different driver's behaviour be compared?

Some insurers are using the data collected using telematics to compare with advanced drivers. One insurance telematics specialist, MyDrive, compares its second-by-second driver data to a fleet of Royal Society for the Prevention of Accidents (RoSPA)-qualified advanced drivers. The theory is that RoSPA-qualified drivers provide a robust, credible, and objective benchmark, and the closer a regular driver aligns with it, the lower their insurance premium becomes.

What kind of feedback will drivers get?

Though it started by merely tracking the location of long-distance lorries and sending that information back to HQ, telematics is increasingly cloud-based, sharing not just data, but insight about driver behaviour and risk.

"The information being shared can be as little as a single red light LED warning indicating to a van driver that they have performed a high-risk manoeuvre," says Tanya Roberts, vice president of marketing at GreenRoad, a cloud service used by the likes of First Group and Stagecoach for their fleets of vehicles.

"Or it can be detailed analysis that shows a fleet manager where vehicles are on their routes; where a driver is consistently breaking the speed limit; or a black spot where a number of vehicles have had incidents."

Basically, you can expect annoying messages from your sat nav system, such as 'slow down' or 'stop texting, you idiot!'

What about the hardware?

It's all going to work via smartphone apps, and we're talking about something a little more serious.

For example, MyDrive is providing an app to Autoline for young drivers in Northern Ireland. "The app is activated each time the smartphone is plugged into the vehicle's power source and will begin to record data on a second-by-second basis once the driver travels at over 10mph for longer than 10 seconds," says Linden Holliday, CEO at MyDrive Solutions.

The app also records data about an individual's driving style, including a driver's level of aggression, smoothness, anticipation, and consistency. This assessment is further qualified by information about road types, such as motorways and A-roads, as well as driving conditions like heavy rain and congested traffic.

Can anything stop telematics?

Although things are changing fast, there is a brake in progress that could significantly slow things down, mainly privacy and data security concerns. In fact, study shows that 55% of younger drivers are opting out of telematics car insurance due to their concerns about privacy. Couple that with people’s reluctance to adapt to new technology and we’re seeing a major slowdown in complete telematics adoption.

How quickly will telematics catch-on in the UK?

As of 2022, Europe and North America saw a total of 30.4 million active insurance telematics policies. With a projected compound annual growth rate (CAGR) of 8.9 percent, this number is forecasted to reach 20.7 million by 2027. The US, Italy, the UK, and Canada remain at the forefront as the largest markets for insurance telematics policies.

Jamie is a freelance tech, travel and space journalist based in the UK. He’s been writing regularly for Techradar since it was launched in 2008 and also writes regularly for Forbes, The Telegraph, the South China Morning Post, Sky & Telescope and the Sky At Night magazine as well as other Future titles T3, Digital Camera World, All About Space and Space.com. He also edits two of his own websites, TravGear.com and WhenIsTheNextEclipse.com that reflect his obsession with travel gear and solar eclipse travel. He is the author of A Stargazing Program For Beginners (Springer, 2015),

- Pam BarrometroEditorial Assistant