MTD: It's not too late to make the right choice

Businesses in rural counties are facing a range of challenges delaying their move towards MTD

Despite statements from politicians, the House of Lords and industry experts, Making Tax Digital is on course to come into force on 1st April 2019. Thousands of businesses, particularly in rural counties like Lincolnshire, are facing a range of challenges that are delaying their move towards digital. However, it isn’t too late for businesses to make the right choices and ensure they’re future-proof and ready for MTD.

From 1st April 2019, every VAT registered business with a turnover higher than the £85,000 threshold will have to keep their records digitally and send VAT returns using MTD compatible software, rather than traditional pen and paper methods.

This will include filing quarterly VAT returns directly from compliant software and maintaining accurate and up-to-date financial information throughout the trading year. Many businesses across the country are still a way off making this move, particularly businesses based in more rural, countryside locations that are still using desktop software, spreadsheets or manual ledgers to document their financial transactions. For businesses that meet the MTD criteria, this simply won’t suffice anymore.

- Coming to terms with Making Tax Digital

- Busting common myths about Making Tax Digital

- Xero - it’s time for accountancy to break out of the dark ages

A giant leap for rural business

Organisations based in rural locations that fall into the MTD regime and are yet to make the move to digital are up against several unique challenges that city-based businesses have not needed to consider. This goes some way to explaining why many accountants may have seen a lack of take up or reluctance from rural businesses.

The hangover of delayed broadband delivery has had a huge impact on this, and has been cited as one of the reasons that businesses are reluctant and concerned about the move from paper to digital. Poor connectivity is a source of frustration for many who are based far from the local exchanges that provide fast speeds. Businesses in places like Lincolnshire simply don’t benefit from the same level of connectivity because conventional broadband services can’t deliver. Instead, there may be a wait for wire-free alternatives such as satellite or 4G to meet growing demands.

In the meantime, traditional mindsets to business operations are hindering MTD progress for many businesses and has created a barrier to change. For a business that works very traditionally and has so far managed without incorporating much technology into their processes, the change is a daunting one. This is in part due to the lack of communication and messaging from HMRC, which has failed to communicate the steps that businesses need to take and how MTD can work for them. As a result, many businesses haven’t understood, researched, and prepared for one of the biggest shake ups in recent tax history.

As it stands, there’s a remarkable lack of awareness about MTD. Brexit has also seriously overshadowed MTD messaging, dominating the headlines for the past three years as every industry attempts to prepare for Britain’s departure from the European Union. If MTD had come around in a time before Brexit, it’s likely that it would have been much more prominent in the news cycle and the message wouldn’t have been lost in Brexit dialogue.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

The part of the story that is sometimes missed is that by embracing some of the new technology and systems that are available, businesses can take huge strides in their processes to save time and money along the way. MTD may well be the catalyst for change, but the benefits of reviewing how a business operates and changing mindsets in conjunction with technology can far outweigh what are very small additional costs of software.

There’s still time

If businesses embrace change now, it’s still possible to make a sensible move towards digital taxation.

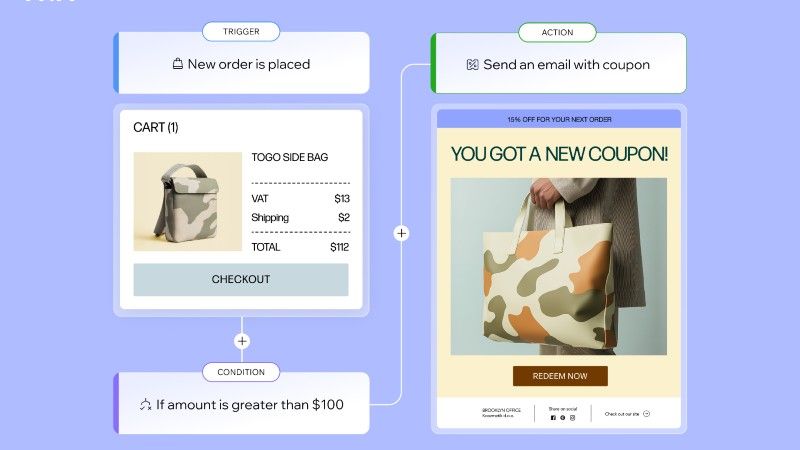

The first step is assessing current processes, which can be an effective way of removing or revising any systems that don’t work, and sourcing a solution that fits. There are plenty of digital software options that are MTD compliant, with Xero being one of the best on the market. Not only is Xero user friendly, but it also integrates systems well to help streamline business processes.

Training is also essential. Many cloud accounting software is plug and play to a degree, but some training may be needed just to set this up. And once the software has been integrated into a company’s infrastructure, the person or team responsible for finances must be trained to make the most of the software.

The good news is that although the official date for MTD is 1st April 2019, many businesses have until summer to finalise their solution. This is when the first post-MTD VAT returns need to be submitted. There are also potential exemptions and a bit of leeway available for businesses struggling with broadband connectivity.

Ultimately, software to become MTD compliant can save a great deal of time and money if the right systems are put in place and used to their full potential. The best way to ensure this is to seek professional advice, and despite a looming deadline, take care not to make a rash decision. After all, the decisions made now to prepare for MTD won’t just have an impact for a month or two, but for decades to come.

Paul McCooey, Accountant at Duncan&Toplis

- We've also highlighted the best UK tax software

Paul McCooey is a director at Duncan & Toplis. He works with a wide range of small and medium-sized businesses, offering accountancy expertise across many industries.