Reinvigorating the UK’s productivity through HMRC’s Making Tax Digital

Small businesses are the lifeblood of the UK economy, but they are not as productive as they could be

Small businesses are the lifeblood of the UK economy. They are the backbone of our industry, providing half of all UK turnover, employing three in five people working in the private sector and turning over £2 trillion for the economy.

However, evidence shows our UK small businesses are not as productive as they could be. Despite being the sixth largest economy, the UK ranks 18th when compared to other countries. The gap in productivity between the top and bottom 10% of firms is 80% larger in the UK than it is in the US, France and Germany.

The Chancellor, Philip Hammond in his Spring Statement earlier this month, even called on the Government’s need to “slay once and for all the twin demons of low productivity and low wages.”

- Coming to terms with Making Tax Digital

- Busting common myths about Making Tax Digital

- MTD: It's not too late to make the right choice

What’s more, in today’s challenging economic climate, it’s never been harder for small businesses to succeed - 50% of them fail within the first five years. That’s not only shocking, it’s unacceptable.

But it doesn’t have to be this way.

We are now at a major moment in time that could catalyse UK SMEs into adopting digital tools and enable them to increase their productivity.

Making Tax Digital

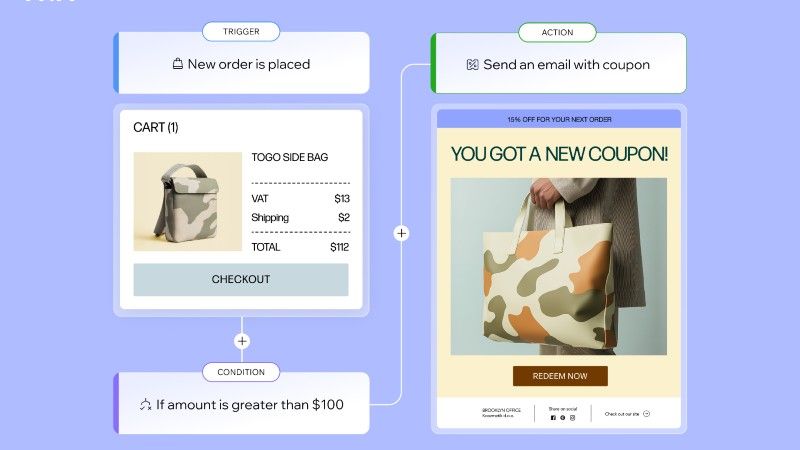

From 1 April 2019, HMRC’s MTD scheme will require VAT registered businesses with a turnover above the threshold of £85,000 to keep digital records and submit returns digitally to HMRC.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

For our small businesses, implementing a digital-led mindset has the potential to open up a world of opportunity and deliver a significant productivity boost – all of which can be catalysed by MTD-adoption.

A new economic model: The Productivity Payout: UK Small Businesses and the Digital Economy, from behavioural economists Volterra Partners, built on predicted behaviours of small business owners demonstrates that once businesses integrate technology to become MTD compliant, further digital uptake is likely to occur.

Further uptake is to be encouraged by the spill-over benefits of digitalisation which will drive increased levels of productivity, by enabling better cash flow and human resources management, and freeing time for more productive activities such as sales, marketing or training. All UK small businesses – those with 10-49 employees – have the potential to see a cumulative increase of £3.9bn to their annual turnover.

Gaining digital momentum

Implementing just one form of digital technology can break down the fear barrier, increasing the chance of further adoption. It can save a business valuable time, increase efficiency and help generate sales: all key factors that can dramatically increase productivity and propel growth.

Digital tools are absolutely essential to any business looking to grow and succeed in such turbulent times. Businesses who fail to adopt digital-first thinking risk losing the agility other businesses gain when they are more open to using digital behaviours.

Without a progressive tech mindset, companies across the spectrum of industry may significantly hamper their prospects of long-term growth and future productivity gains.

There are potentially 625,000 small businesses that are not using any type of financial management software and with just days to go until the biggest change to tax in a generation - Making Tax Digital - comes into force, now is the time for UK small businesses to embrace digital with optimism, to dramatically impact their growth, future competitiveness and productivity.

I speak to hundreds of small businesses every year. I know their fears. I know their struggles. But most of all I know their successes. I know that when digital and automation meet, we can supercharge productivity and usher small businesses into a new era of prosperity with the greatest chance of success.

Chris Evans, VP and UK Country Manager at Intuit QuickBooks

- We've also highlighted the best UK tax software

Chris Evans is Vice President and UK Country Manager of accounting software, Intuit QuickBooks. Chris has been part of the company’s UK team for the last nine years, his previous role was UK sales director. Chris’ mission is to work hand in hand with the accounting industry to enable small businesses embrace digital, solve cash flow and unlock growth.