TechRadar Verdict

Pleo wins praise from most who try it and for good reason. This is one of the best expense trackers out there and its features, functions and value for money appeal make it a hit.

Pros

- +

Affordable

- +

Excellent app

- +

Integrates with accountancy packages

Cons

- -

Very little

Why you can trust TechRadar

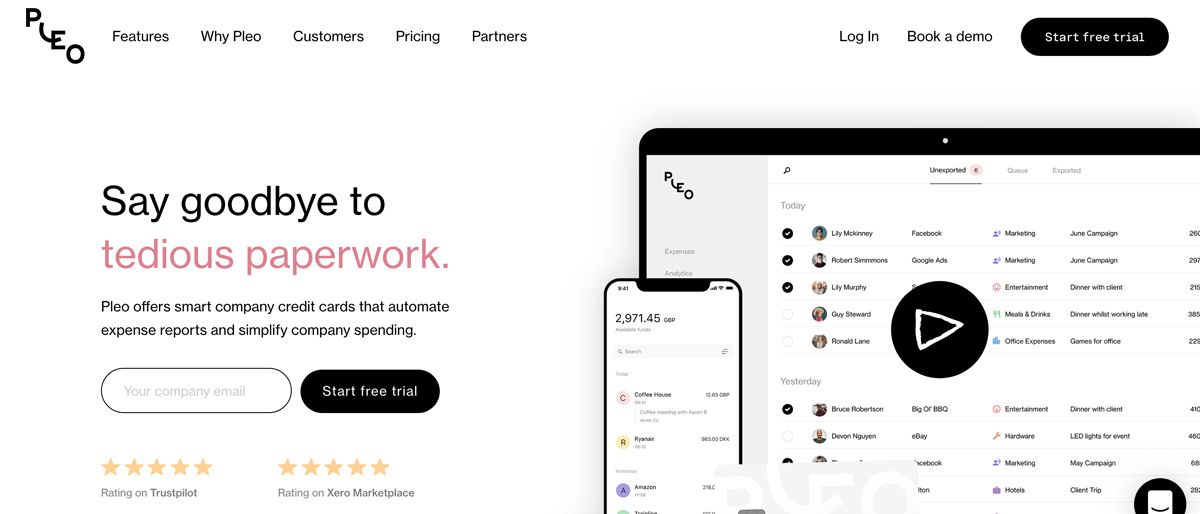

The Pleo expense tracker is a relative newcomer to the world of expense management but the London-based venture is already stirring up a good deal of interest across Europe. Currently available in the UK, Denmark, Germany, Spain, Sweden, Ireland and France the expenses tool features an innovative edge, carries bank-level security and is FSA and PCI regulated.

It offers a combination of smart company credit cards that allow business owners and employees to automate expense reporting and streamline this often tedious procedure. As well as helping to tackle the tedium of expenses admin, Pleo is boosted by a receipt-catching app and also benefits from integration with popular accounting software.

Other expense trackers worth considering currently include QuickBooks, Rydoo, Expensify, Hurdlr, Zoho Expense and Pocketguard all of which are undeniably useful during the ongoing coronavirus crisis.

- Want to try Pleo? Check out the website here

Pricing

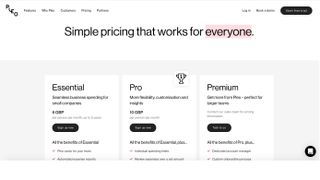

Pleo comes with the option of a free trial so you can get acquainted with its features and functions. From there it’s a case of choosing one of three different packages. Things start off with the budget Essential option, which is £6 per person, per month for up to 5 users. This comes with plenty of basic features including Pleo cards, automated expense reporting, the ability to capture receipts and delivers integration with your accounting software. There’s also an automatic email receipt finder plus you can manage out-of-pocket expenses with ease.

Next up, and Pleo’s own recommendation, is the Pro package. This takes things up a notch or two from the small company appeal of the Essential package. For £10 per person per month Pro comes with everything found in Essential along with individual spending limits, custom reviewing of expenses, real-time analytics plus the ability to give access to external bookkeepers.

Rounding things out is the Premium edition, which is aimed at companies with larger teams with more logistical challenges to face. You’ll get everything in the Pro version plus the likes of a dedicated account manager, custom onboarding processes and on-site training. There’s also the benefit of being able to reclaim foreign VAT along with a business travel insurance option, which can be tacked on for a fee.

Features

The team at Pleo has definitely opted to go for the ‘simple is best’ approach and the way this system works is definitely straightforward. Employers can give their employees company cards, which can have specific budgets allocated to them and they’ll subsequently be able to pay for everything needed on a day-to-day basis.

Pleo aims to remove the need for conventional filing of paper receipts too, so it’s easy to capture paper receipts and integrate them into the system without fuss.

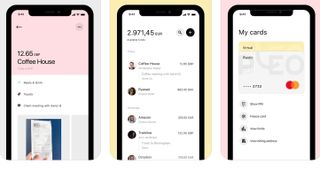

Similarly, office managers and administrators can get a real-time overview of what's happening with the company expenses and it all gets updated on a dynamic basis. Central to the way it all works is largely down to the Pleo web app that has been nicely engineered to meet all of your expenses needs within a mobile-friendly interface.

Performance

At the root of Pleo’s appeal is the web app and that has been well put together with plenty of consideration given to larger organisations that have multiple employees. Indeed, its Teams section allows office administrators to keep tabs on many different workers and group or sort them where needed.

Considering this might often involve quite a lot of data-intensive workflow Pleo has done a fine job of making the app feel suitably nippy. Overall there doesn't seem to be any aspect of the Pleo experience that makes you worry about its performance capabilities.

Ease of use

There’s a lot to like about Pleo, especially when it comes to ease of use. The way that the package can also be integrated to work with your accounting software tools means that it should help streamline the expense chain of events. Pleo’s web app is where most of the employee interaction happens and its appeal is boosted with a very fuss-free design.

Core menus include My Cards, Expense, Analytics, Wallet, Teams, Plastic Cards, Export and Company Info. There’s a neat Get started option too and this will have you up and running in no time. The real strength of course is the way that each user gets a Pleo virtual card on enrollment.

Meanwhile, plastic cards are optional and can be ordered by an administrator. Users will also have access to a company wallet, which employers can use to allocate funds to specific employees. So no matter if you're an employer or employee, Pleo seems to tick all the right boxes.

Support

The good news is that Pleo is, by and large, very easy to use, so hopefully there won't be too much need for support along the way. If you’re a larger business that has plumped for the Premium edition then you’ll have a dedicated account manager anyway, which will cover most bases on the support front.

If you’ve got either of the other two packages then there’s an excellent Pleo Help Centre on the website that covers just about everything you want to know about the way it works. There’s on-call support for all levels of package options, though if you’re likely to have an ongoing need for higher levels of assistance then the Premium edition is the obvious way forward.

Final verdict

Pleo comes packed with promise and has to be one of the easiest expense tracking packages there is. It’s not just about offering convenience and efficiency either because there are plenty of practical features to consider.

Integration with accounting packages including Xero and QuickBooks is a real boon, as is the option of giving your employees either virtual or plastic company cards, or indeed both.

Apple Pay functionality has also been added to the Pleo features arsenal and the digital and audit-proof receipt capture works as seamlessly as you could hope for. With a keenly priced trio of packages and an excellent app Pleo has plenty going for it.

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.