TechRadar Verdict

Affordability is everything when you’re moving cash from one place to another and Wise proves to be great value, reliable and offers innovative supporting features too.

Pros

- +

Solid mid-market rates

- +

Great apps for iOS and Android

Cons

- -

Customer service number not immediately obvious

Why you can trust TechRadar

Wise, formerly TransferWise, is a peer-to-peer money transfer service, originally started by two Estonian Fintech innovators, Taavet Hinrikus, (Skype’s first employee) and Kristo Käärmann based in the UK. It offers a variety of products and services resulting in over £5 billion being moved around every month, even in the wake of coronavirus.

Wise states it saves individuals and businesses £3 million in hidden fees every day. Currently the service is available in 59 different countries, although it is also adding to that list and now has offices in 14 different locations around the world.

Alongside its transfer service, Wise has recently added a multi-currency account, which lets you hold over 50 currencies at once and convert them when you want, along with a Wise debit Mastercard. The service is up against similar products from WorldRemit, Azimo, Venmo, Western Union, PayPal, Zelle and Moneygram to name the key players in the currency exchange marketplace.

- Want to try Wise? Check out the website here

Pricing

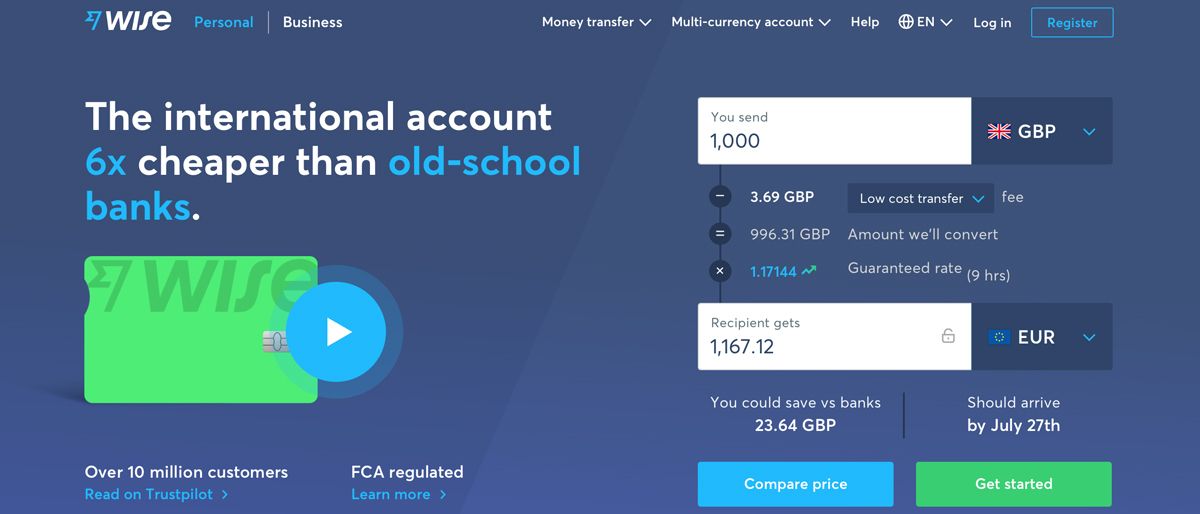

The Wise fees page illustrates nicely how its fees are broken down. A percentage of the charge is a fixed fee, followed by a variable fee, which are both added together to give you a total fee on each transaction. There are three different transfer tiers too, with a fast option being the most expensive, an advanced middle-tier option and a low cost transfer to pick from depending on how fast you want to move your funds.

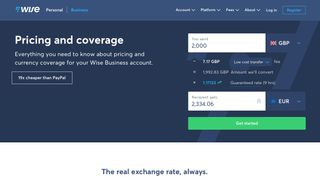

Wise does also offer Business pricing, which adds in extra features that are free, including the ability to receive money in EUR, USD, GBP, PLN, AUD and NZD currencies for free. This comes with a 0.33%-3.56% fee to convert currencies. The supporting Wise debit Mastercard comes free too, with the same currency conversion fee of 0.33%-3.56% plus a 2% fee of ATM withdrawals over £200 per month.

Much like others in this marketplace, the Wise website has a dynamic calculator so you can work out your fees in advance of moving or receiving any cash.

Features

If you’re moving money, particularly larger sums, then getting access to mid-market exchange rates like banks enjoy is always a bonus, which is what Wise manages to do as part of its setup. With a straightforward fee structure, that you can see displayed on its website, plus a speedy money moving service, TransferWise is a quick and simple solution.

The website works well enough on a desktop browser, but there’s also a very good supporting app for iOS and Android, which might be more useful if you’re looking to transfer money on the move, either for business or holiday needs. Wise also prides itself on being safe and secure – it uses a 2-step login process and verification procedure.

The service is additionally complimented by its business account, along with its multi-currency Mastercard debit card, aimed at keeping costs lower if you're spending overseas.

Ease of use

Much like similar money transfer products and services, there’s not too much in the way of inner workings, at least for the customer to see that hinders progress if you’re using Wise. It’s a web-based system, works out your fees dynamically and does the same with current exchange rates.

Overall then you’ll find that Wise is very easy to use. Wise has done a really good job with its mobile app editions of the service, with both iOS and Android options available.

Support

The Wise website is the place to head for a comprehensive series of FAQs that should tackle most, if not all of your queries about every aspect of the website and using it. The company also has useful blog, Facebook and Twitter pages.

Final verdict

Wise says that it has three core principles that drive its service, which is to remain transparent, to charge as little as possible and to keep transfers simple and instant.

Interestingly, Wise wants to put the focus on providing premium features without charging too much for the privilege and highlights its efforts to offer support to customers in their own language and time zone.

Better still, they aim to make this support real, rather than from automated systems. Bold claims and with what appears to be a transparent fee structure there’s quite a lot here to like. Wise is also authorized by the Financial Conduct Authority and those mid-market rates are perhaps what makes it most appealing of all.

- We've also highlighted the best money transfer apps

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.